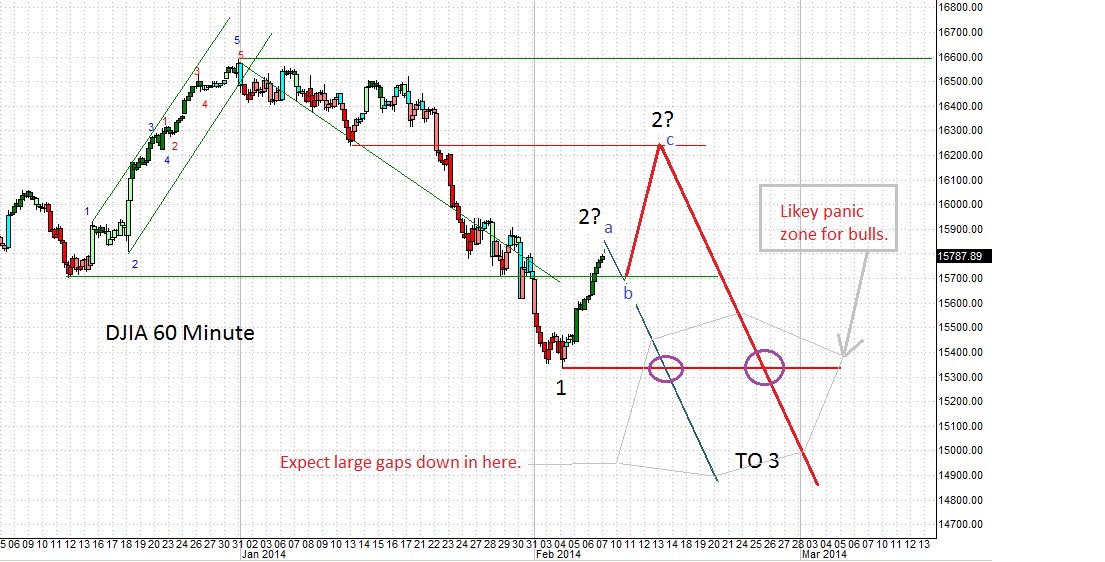

The DJIA has made 5 moves down into what is likely to be wave 1 of a new bear market. However, it could also be A of C. With either 1 or A complete, the market is now working on 2 or B. I think it is 2 but for short term swing trading purposes it really doesn't matter. Wave 2 should come as a 5-3-5. 5 up almost completed last Friday and so it makes sense to see a small pop at the open and then for selling to take hold down into B. It should draw in a few more shorts before crushing them with the C of 2 wave while giving bulls one more shot of false hope. They still believe a bull market is in play. They still believe that the recent down draft was just a speed bump in the autobahn super highway of Perpetual Ponzi Prosperity. Now that they have rolled over it, they think it is back to the races.

Don't take the exact levels of the chart below for gospel. The main thing I was trying to show was chart shape. In fact if this is the a-b-c model playing out then a could be a bit higher than shown by the starting point for blue line back down. In other words, a could go to Dow 16000 or so before working on b. But where ever a stops, we should assume c will be about the same length. And we should definitely assume that a c will occur for now because this is a 2nd wave and 2nd waves are often vee waves as the market thinks the pullback is over and everyone buys the dip.

In any case, if the wave ever hits a lower low than the prior black 1, it means that the sucker's bounce is likely over and the wave 3 (or c) down is in progress. That will be a time of growing panic for the bulls because their recent attempt to buy the dip will have failed.

If you shorted this market and failed to cover for this bounce, don't panic yet. Wait to see if the Dow hits a higher high. I model 90+% chance that it will not. In other words, if you bet in the direction of the trend but your timing was bad, hang on as the market will catch down to you. But there is a clear trigger to this strategy as well: a new high for the Dow means ALL short bets should be covered immediately.

Sunday, February 9, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment