This page on investing is perhaps one of the most important bits of economic information you will ever read because it points out a truth that is so ridiculously fundamental and obvious that it is hiding in plain sight. I can pretty much guarantee that you will roll your eyes at the concept that I am about to explain here but after you get done with your herding instinct reaction, let your brain dissect my statements and test their veracity with math and logic instead of gut feel and emotion. If you are honest with yourself you will find it very difficult to disagree with my statements after carefully considering them.

And so here it is: the very concept of investing is a scam. We have been herded into it like the sheeple we are (just a reference to the herding nature of our species, not a statement about intelligence). We have been told to accept investing as the normal and prudent thing to do. We have been told that people who don’t invest are a subclass who will go hungry in their retirement years. We have been told whatever had to be said in order to get us to buy into the money scam which people now call investing. Thus, when someone tells the truth of the matter, the first reaction has to be rejection, even repulsion. How can anything so fundamental to capitalism as investing is be wrong?

Well, let’s go back to the real goal. Do we want investment for investment sake? Of course not. The whole concept of popular investing is quite recent in history. Where was the stock market back in Roman times? How could anyone get by without investing back then? The answer is that they did it just fine because there is no need to invest. What there is a need to do is to save. Before the concept of money, the elderly had to rely on the nuclear family for care during retirement. If the parents took good care of the children while they were young, the children would in turn take care of the parents when they got old. That was the social contract. That was how people got along. It was the free market version of social security. Parents were working to raise the children. The adults were feeding and clothing and sheltering themselves but they were also working a bit harder in order to do the same for their children. Parents thus stored some of their excess labor in the bringing up of children and when they got old they expected that this excess labor would be taken back out of this savings mechanism; their children would work to support them in their old age when they could no longer fend for themselves.

As society evolved, the concept of money evolved with it. Money allowed people to store their excess labor into commodities like gold and silver instead of into the lives of children. Why was that considered a benefit? Simply because not all children appreciated the fact that their parent’s energies in bringing them up was actually a savings plan. Thus, when some of the parents got old and needed to make withdrawals from that savings plan of stored labor, the children defaulted on the promise by not caring for the parents. In other cases, the children died thus representing a 100% loss of the stored labor of the parents.

A key value of the invention of money is that if you save some of your excess labor into money instead of using it all to raise children then you were reducing your retirement exposure to the whims of ungrateful children or to the chance that they would “die on you”. The concept of money meant that labor stored into this commodity form could be converted back into physical labor of anyone in society during retirement, and the conversion could be done upon demand (not just when your kids had time for you). Under this new system, your entire family could get wiped out in a car accident without bankrupting your retirement plan. In fact with the new scheme, all of society would have to fail for that to occur. This represented a huge reduction of risk to savers and herding species like ours are all about risk aversion.

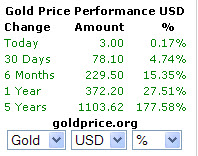

The big scam, the one that only 1 in 10,000 or less understand, is that investing is not the same as savings. To the vast majority, these terms are synonymous. So let me break the scam down here. People don’t want to invest; they want to save for retirement. But in an economy that is controlled by fiat currency (government-defined and mandated “money”) and fractional reserve banking, you can’t simply save your excess earnings of today and hope that it will retain its buying power when you retire. Such a belief is best left to the feeble minded and math challenged. It is obvious that the dollar of 1913 had far more buying power than it did in 1940, 1960, 1980 or 2011. In fact, the chart shows that the dollar has tanked in

value relative to real money (gold) in just the past 5 years. Gold is up 177% relative to the dollar over that time period. Anyone saving for retirement in dollars is watching their purchasing power evaporate before their very eyes. Bottom line, a fraudulent money supply such as ours that is based on fiat currency and fractional reserve lending does not serve the fundamental purpose of money which is to be a reliable store of wealth (i.e. buying power).

It is because our money supply is fraudulent that people have agreed to be herded into markets where their money can hopefully grow to keep up with inflation. In essence, people have gotten the message that they either gamble their retirement savings in the financial markets or the government will steal them via inflation. While this is an obvious scam, people have been duped into agreeing and participating through all sorts of social means. Perhaps the main tool for this has been the age old con tactic of appealing to a person’s greed. How many scams could ever really work unless the mark believed that he was getting something extra in the deal? Very few. There has to be some bait in the trap or the con men will not be able to sucker many patsies into it. By the way, I use “sucker” as a technical term devoid of emotion or judgment. It is simply a verb meaning to entice the unwary into a trap. The same goes true for the term “patsy”. It is not used as an insult but rather as a noun to describe the target of a confidence scheme, AKA “con game”. But to my point, you need some honey if you are going to trap people.

The honey that has baited the trap takes a general form which is the promise of something for nothing. It is a powerful play on the greed which is genetically imprinted into our species. Something for nothing generally takes the form of “you get more out of the system than you put into it”. It is not truly something for nothing; that would not work for those who are running the con. You must have something in the game so that they can sneak it away from you. What they claim is that if you put a little something in today then you will get more out of it later, and here is the key part of it, without having done any more work to deserve it. People who are truly versed in economics know that new value only comes from the labor of man and thus it is completely impossible for a system to exist in which everyone gets more out of it than they put into it, each without having done any more work to deserve the additional payout.

Of course, such systems can appear to exist and in fact maintaining this appearance is the very essence of the con game. Con men who are benefiting from the existence of the con will tell you to remain in the system, that you will get your reward, etc. when they know damned well that it is impossible for everyone to get more out of the system than was put in. The mechanism used to maintain this appearance is the Ponzi scheme. The first to exit the system get full payouts. They absolutely do get more out of the system than they put in. While this lends credence to the system, the truth is that the payouts come from newcomers to the Ponzi. The more that exit with full payouts, the less is left for the patsies that remain in the system hoping for their eventual payout. It is mathematically guaranteed to collapse at some point.

At least 80-90% of the investments out there which we have been collectively herded into are simply debt Ponzis. They appear legit but when the boomers begin pulling their cash one of three things absolutely must happen:

- The asset prices will plummet before a large number of patsies can exit. The remainder can sell out and get 10 cents on the dollar. This is the most likely outcome. It's supply and demand 101. Too many sellers and not enough buyers.

- The funds will default because they do not have enough cash to make the promised payouts.

- The government will inflate like crazy. Payouts will be made with new dollars printed from thin air, but each dollar will have less purchasing power than before.

The mechanism of Ponzi termination doesn’t really matter. In all cases what is lost by the patsy is buying power (which you can think of as a diminished ability to convert one’s stored wealth into the labor of another individual). They are effectively losing some, most, or all of their stored labor. Value is much like energy in physics: it requires conservation of energy. If a certain amount of value is pumped into a system, that value remains until it is removed. Of course, it is impossible to remove more value from a system than was input. So in the very best case, everyone will only be able to extract exactly the value they put in. In the real case, the con men are siphoning value out the back door with fees and administration costs and legal fees. Those who are wise enough or lucky enough to exit the Ponzi at full promised payout (which is more than they input) simply leave less to be divided by the remaining patsies.

All of this is going to happen in your lifetime. It mathematically has to happen because the boomers are retiring en masse. If they are all allowed to take out more than they put in (as they were promised would happen) then fundamental laws of economics will have been violated. That cannot and thus will not happen. People might take more dollars out of the system in aggregate than they put in but they cannot and will not in aggregate take out more buying power than was put in. Period. So anyone who tells you to invest and that your money should work for you, etc. is a con man. Investing is not the same as saving. Investing is the attempt to get something for nothing and that, folks, is a key characteristic of gambling. What so many call investing today is nothing more than gambling that the Ponzi will not collapse before they get their stored value out of it. Everyone is looking at the door nervously trying to plan their escape to beat the next guy out the door. That is where the investing world is right now.

Conversely, converting dollars into physical gold which you intend to store for consumption during your retirement years is not investing at all; it is saving. It is saving in the purest, most convertible, most universally recognized form of money to ever have existed in the history of man. Every person on every continent will recognize a gold coin as having value and they will gladly work for you in exchange for it, they will trade their food and clothing for it, and they will trade their local currency for it. For intelligent people, gold is not an investment to be traded daily or monthly or yearly based on the wild fluctuations of the perceived value of the dollar. Gold never really increases or decreases in buying power for very long. A 1 Troy Oz. gold coin still buys about the same amount of quality clothing today as it did back in Roman times.

The only intelligent goal of saving gold is to maintain the buying power of the labor that you used to earn that gold with initially. Hoping to profit from “investing” in gold is a fool’s errand. Gold is money and money does not self replicate without the addition of labor. Don't expect alchemy to happen and you will not be disapointed when it doesn't happen! Gold is money and saving money is a responsible and adult act which is quite dissimilar from investing (which is more akin to a trip to Vegas with your retirement savings). Now stop rolling your eyes and actually think about what you have just read. Stop letting others do your thinking for you. Pull away from the herd long enough to recognize the truth when you see it.

A long term program of dollar cost averaging (buying small amounts of gold over time) is how you will certainly win. Just ignore the month to month fluctuations because those are the fluctuations of the dollar, not of gold. Expect fiat currency to glow brightly and then dim in increasingly rapid succession just as would occur with a dying star that is about to explode. Gold will survive the economic supernova which will mark the death of this cycle's fraudlent money supply based on fiat currency and fractional reserve banking.

A long term program of dollar cost averaging (buying small amounts of gold over time) is how you will certainly win. Just ignore the month to month fluctuations because those are the fluctuations of the dollar, not of gold. Expect fiat currency to glow brightly and then dim in increasingly rapid succession just as would occur with a dying star that is about to explode. Gold will survive the economic supernova which will mark the death of this cycle's fraudlent money supply based on fiat currency and fractional reserve banking.