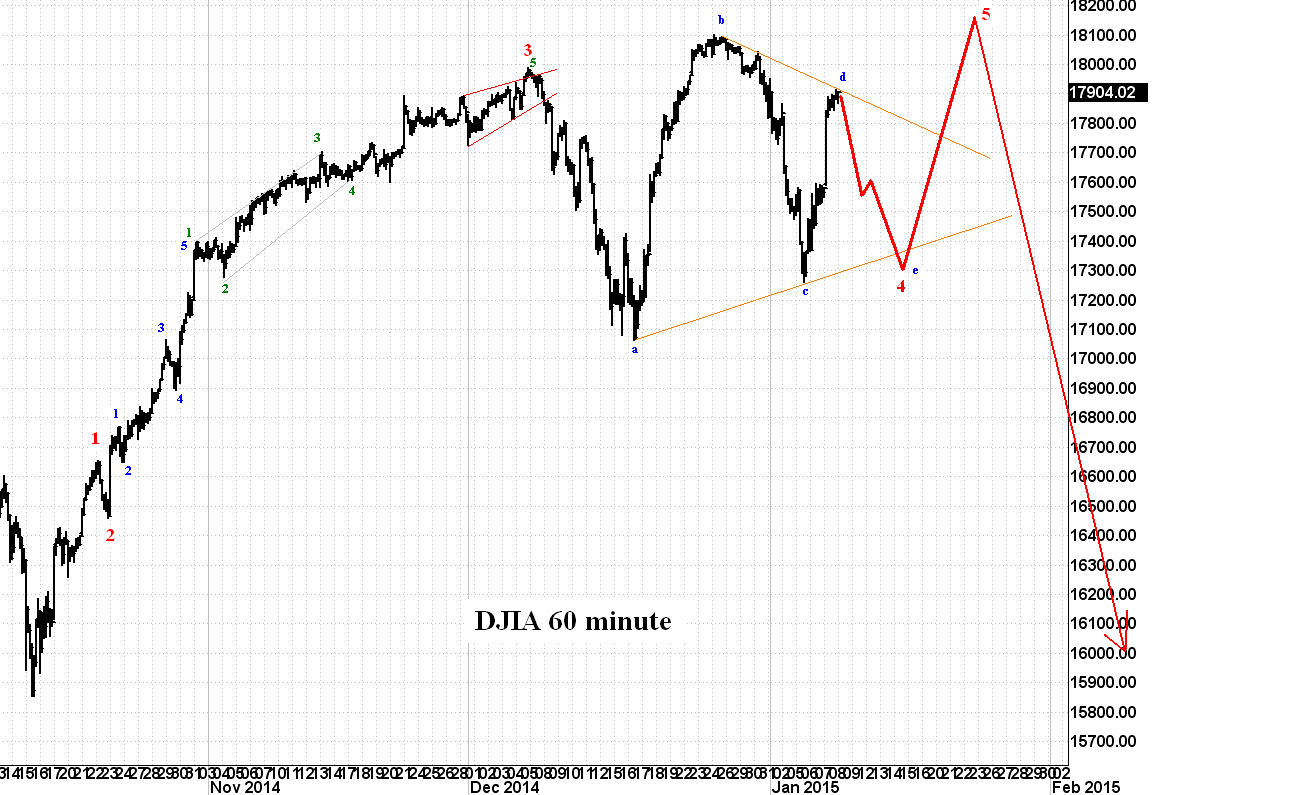

Zooming way in, here is my count so far. This model expects some follow through action on the DJIA into tomorrow starting with a small gap up at the open. The expectation is that the DJIA is working on green 5 of blue C. The total height of green 5 should be about the length of the blue vertical which is the height of green 1.

Zooming way in, here is my count so far. This model expects some follow through action on the DJIA into tomorrow starting with a small gap up at the open. The expectation is that the DJIA is working on green 5 of blue C. The total height of green 5 should be about the length of the blue vertical which is the height of green 1. At that point it should be safe to re-enter UVXY, at least for a short term trade.

The expectation of the conventional wisdom EW model would then be a complete retracement of the last 3 days of rally and then entry into a deep bear market.

That's the expectation.

The threat is that the model will be wrong and that instead of falling through green 4 and then all the way to lower lows, the chart will just pull back a-b-c to green 4 and then put in another full motive wave that is the same height as blue A. In other words, it will nullify the correction model and become motive instead.

Even if the a-b-c correction model remains intact, given the extent of today's rally we have to wonder if the subsequent sell off will be to a lower low or whether it will form a horizontal triangle. Only time will tell about that but it would take the unusual shape as shown below. Still, if we are near the top of the entire bull market we should expect trickiness, head fakes and whiplash in order to throw as many hounds off the scent as possible.

Again, drive for show, putt for dough.

No comments:

Post a Comment