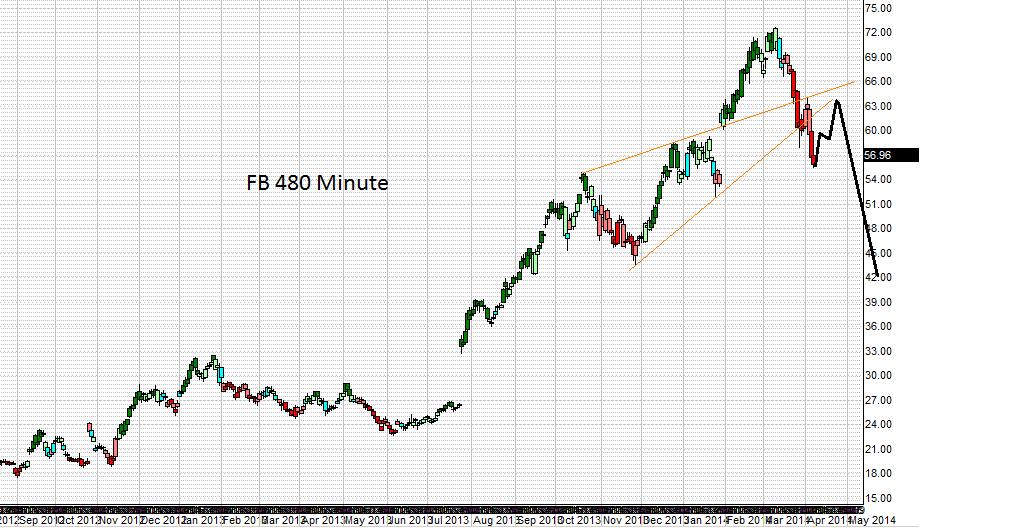

I was a little bit early in my original topping call on FB shares but I wasn't wrong. FB has been the poster child for a worthless momo stock in free-fall of late. In this most recent post I indicated that it was in "3rd wave free-fall". To date that has been a good model. But I'm looking at other momo stocks right now and they see ready for a breather from the beating. If they rally, FB might do so as well. Of course, it also might trade sideways while the broader markets bounce and I also might be wrong about the tech/momo markets getting a bounce here. But we should know very early tomorrow. Stocks like TSLA and other will either bounce here right at the open or they will tip their hand that the 2009 rally is indeed over. Long time careful reader know that this would not surprise me as in fact one of my models predicted recent peak of the DJIA to within a few dollars one day in advance of it happening in this post.

In any case, FB shorts should consider covering if there is any strength at the open. If the strength is a head fake you can jump back in quickly the minute a lower low appears. But FB could not push a dramatic test of resistance from below as shown in the model below. It's that happens you would prefer not to sit through it. This move is not guaranteed to happen but if it does and if the lower resistance holds (it likely will), then short this thing like you mean it after you see a-b-c (5-3-5) bounce to do the "kiss goodbye" as that would be the kiss of death. Stops should always be used in case the market tries to pull a fast one of course and those stops should be placed above the top resistance line in this case.

Monday, April 7, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment