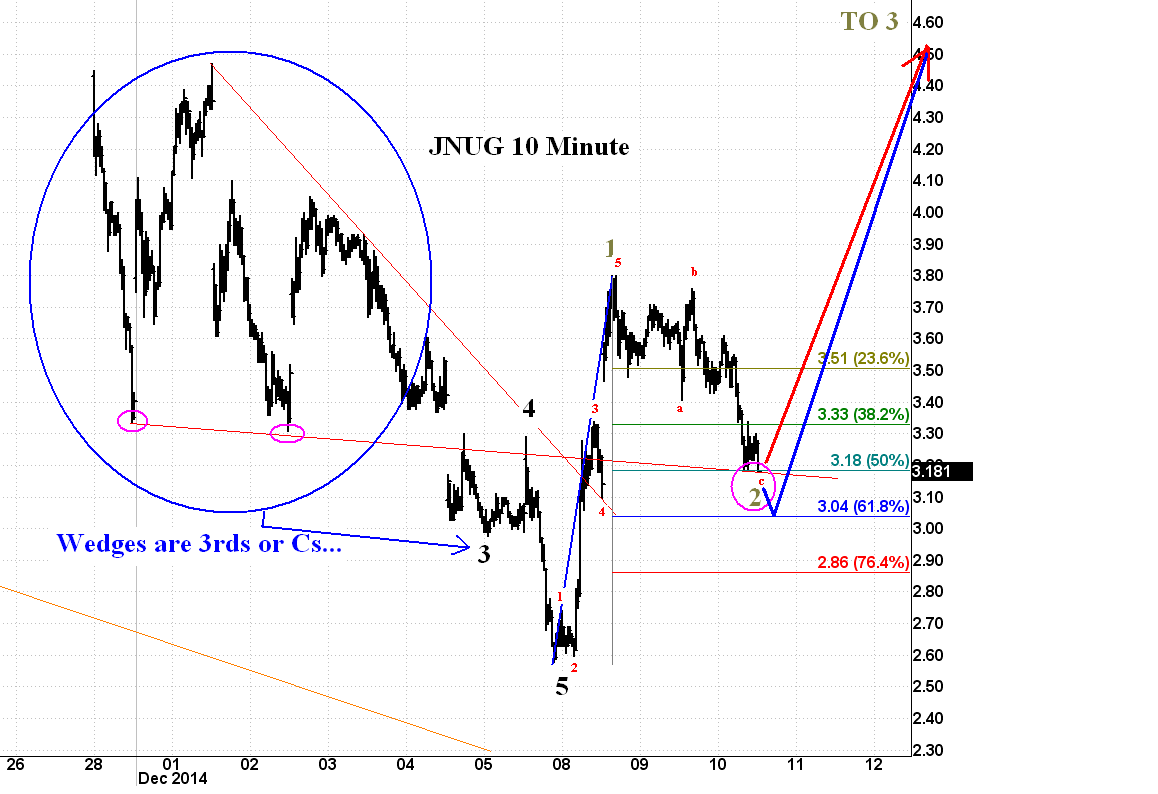

Refer back to this post. I was looking for a small pullback then then a breakout. While this did indeed happen, the action since tells me that we were likely working on 5 and not 3. Per the updated count below, the chart is now in the process of pulling back to the level of the prior 4th which will either reverse at the 50% fib or possible go as low as the 61.8% fib before most likely moving back up to new highs.

I've updated my count as shown below. Since it is always possible that what I have labeled below as black 5 can actually be black 3, I recommend using stops at $2.99. Even if this is a 5th wave down unfolding right now I suspect it will not go below that big dip on the 8th. It might close the gap at $2.86 and then form an inclining double bottom.

People who think miners are going to zero are just as misguided as those who think the federal reserve can just print money endlessly to prop up the stock markets. Gold and silver have likely bottomed and miners will bounce once the market recognizes this fact.

Now hear this: after all the ridiculous panic selling that has occurred in the juniors, which I am quite sure includes a ton of short selling, the pop to the upside is going to be fast and furious. Before the miners went into high volume capitulation collapse I was thrilled with the prospect of possibly hitting $6 on JNUG. But it actually bottomed as low as $2.58 recently. Does anyone really think all of the juniors are going to BK right now? The level of selling we have seen would suggest that this is the case. I don't believe it! I believe JNUG hits $30 from these levels.

Just as yesterday was documented as a "defining moment" for UVXY with clear wave count bias to the upside, I think JNUG is at the same point in its count. In other words, it will have to either shit or get off the pot very very soon. I cannot guarantee that it will resolve to the upside without first experiencing a lower low (even though that is my strong bias). But even if you just bought at this level and then ignored further volatility going forward you will eventually end up bright green on this trade. It's just so much nearer to a low than to a high that the odds strongly support a rapid move up that will be measured in the hundreds of percent.

Of course, trust but verify.

Don't ride this stallion bareback until we have 5 confirmed wave up yet (which we do not as of this writing).

Per above, stops at $2.99 but if you get stopped out and it goes back above $3 that is the buy signal. Hold above $3, sell below it and look for a lower entry point if you can get so lucky.

Wednesday, December 10, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment