Here is the backlink to my first CJES post when CJES was trading at $12.08. I wrote,"From 13 down to $12 COULD be a falling wedge 3rd of 5 of 5. So maybe it goes down to perhaps $11.50, bounce s a little and then

maybe as low as even $10.50 before it is really done- I tend to be a bit

early in these counts. But this will be a lot higher come mid January

than it is today."

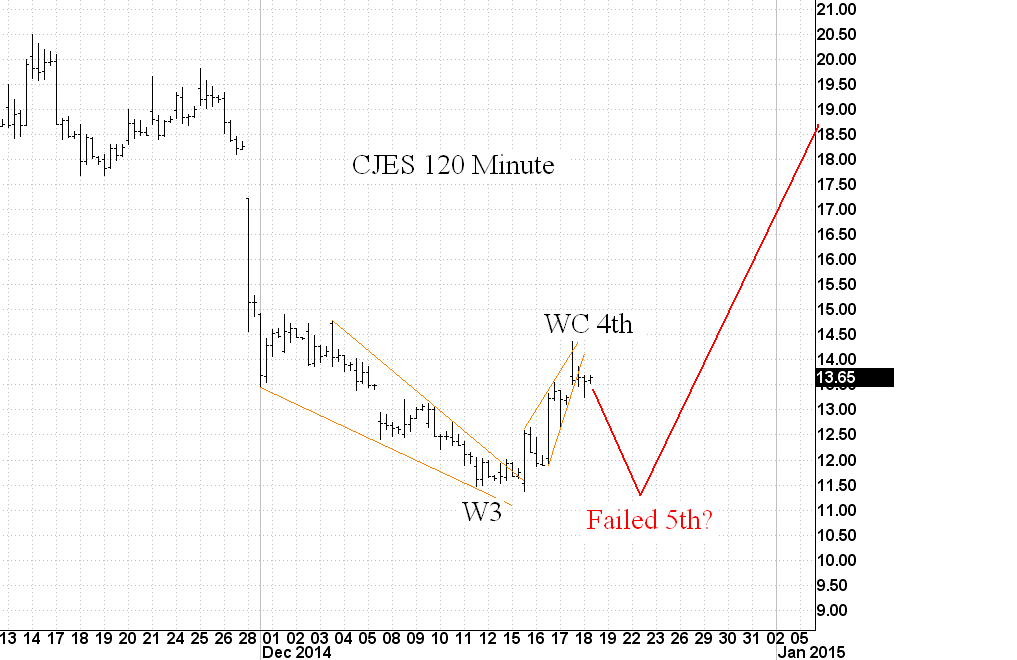

So as you can see since then it bottomed at $11.39. After looking at the wave which completed on the 11th, it looks W3 to me. So I am now counting that as a 3rd. The subsequent waves look WC so I will count it as a 4th.

Wave 1 ran the 14th-19th in the upper left. It was about 5 units and change in size. That is what I would expect for wave 5 down. So it looks like we will get some kind of double bottom here and that is where the smart trader (who is not already deep into other more highly leveraged commodity plays...) will take a bite after 5 small waves down. So we could end up with a failed 5th here or maybe a 5th that is just a tad lower than W3 but hoping for $10 is likely a bridge too far.

Again, for those looking back at this post in the future, I don't know jack shit about CJES except for what I scanned from the yahoo "fundamentals" page in less than one minute. NONE of my prediction have to do anything with any kind of traditional "fundamental" metric because I don't think they matter at all to the share price. The only important thing is the wave count. It truly represents all of the real fundamentals, all of the insider trading, all of the problems within the company, all of the opportunities for the company, etc.

Time will tell if I got this model right but I like my odds. Note: I am not playing this because it is not highly leveraged enough for me. But for some people 15-20% in 3 trading days is a nice speed.

Thursday, December 18, 2014

Subscribe to:

Post Comments (Atom)

1 comment:

"But for some people 15-20% in 3 trading days is a nice speed."

I'm one of those people. With a big smile. Your research and perspective are always appreciated!

Cheers,

Chance

Post a Comment