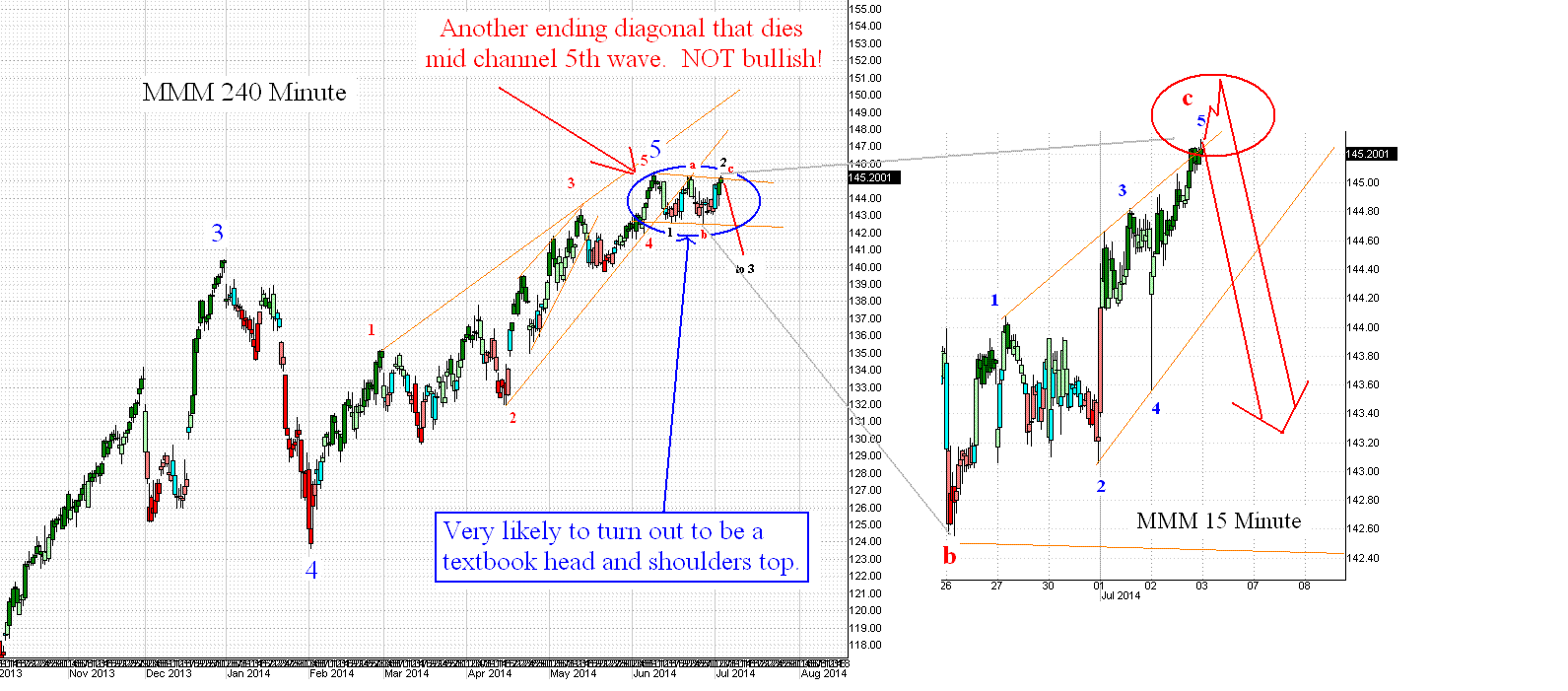

This link will get to to what I think is my first post on 3m (MMM) in these pages. As mentioned quite a number of times in these pages, the 2007 peak was marked by lots of head and shoulders across the board. While not yet confirmed, MMM is like AXP in that is has not rallied and broken out like so many other stocks have done this past couple weeks even though it had every opportunity to do a wild 5th wave ending diagonal throwover without anyone batting an eye. Instead, it finished its 5th wave mid channel - something I again have mentioned as a common stopping point for them - and then broke down just below the lower rail and then slid up that rail in an obvious back test of the new resistance from below.

I think that break down of the lower rail was wave 1, the first move up to back test was a of 2, then b of 2 and now we have likely finished or are within a day or two of finishing c of 2 (as you can see from the 15 minute zoom in to the right). After that I expect a pretty rapid breakdown below the neckline of what will then become a confirmed head and shoulders breakdown. This has to play out quickly or the likelihood of the H+S diminishes rapidly. H+S are generally jagged deals, not rolling curves.

Because the MMM chart is going darned near straight up (from $40 to $145 since 2008), I expect that its crash will equally undershoot to the low side. This stock is being bought up like hyperinflation is here today and that is just not happening yet. AFTER the big deflationary crash, YES. But not before.

Wednesday, July 2, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment