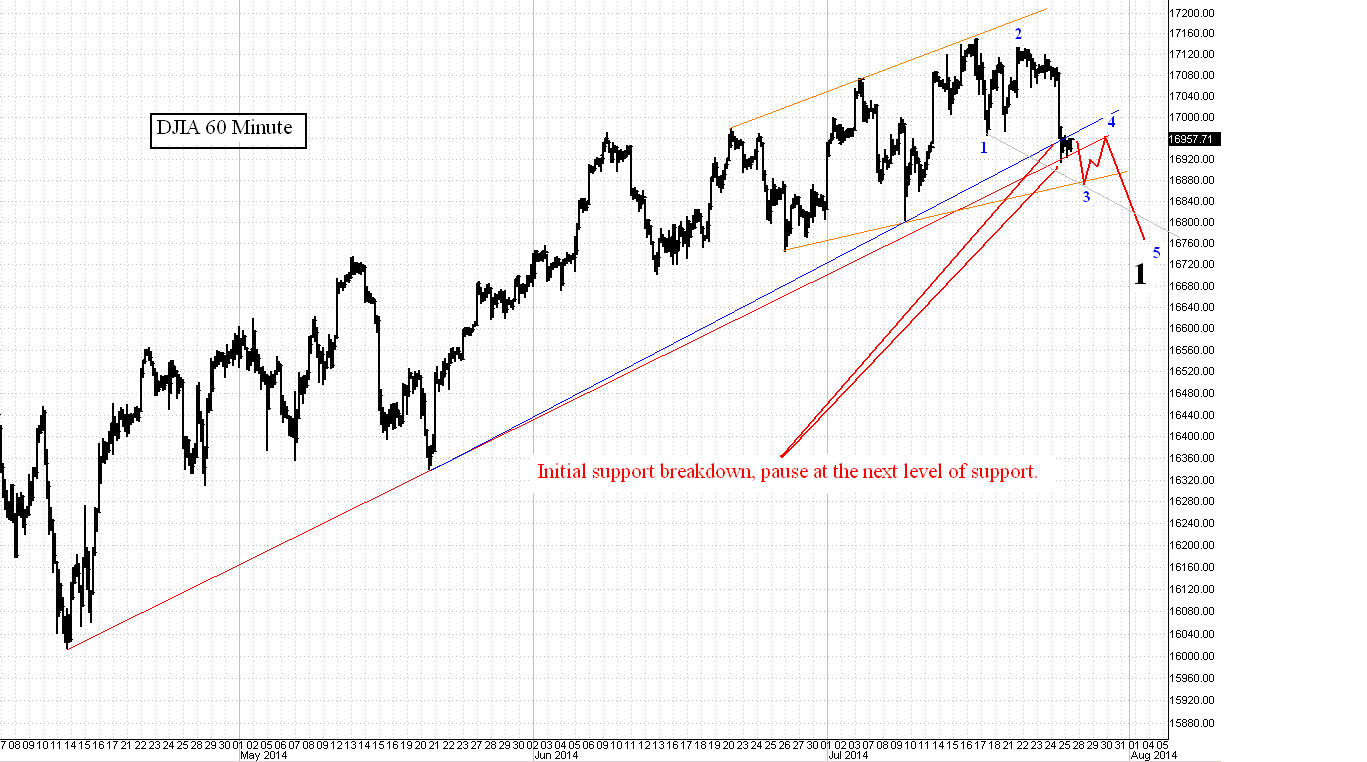

Today played out pretty much as expected. The chart broke down through a support level that was not shown before (the blue line) but paused at the more significant longer term support line (red). From blue 2 I count 1-2-3 and 4 but not blue 5 yet. That little black ball that we ended today with looks like a triangle which would imply one of two things:

- Either it is a 4th wave that will break down below the orange support line pretty early in the day on Monday.

- Or that little triangle is telling us that there is 1 more wave left upward in some complex structure that I have not visualized yet. For now I'm going with the former but will be open minded about it if we do not get a break down as shown below very early Monday.

If the breakdown does not occur on Monday then I suspect we will get the model below instead. The S+P would also rally thus giving it a chance to test 2000 (which a lot of people see as likely right now). Below is my alternate, above is my primary but not by a huge margin. I will easily change my mind based on what happens in the first 2 hours of Monday's trading.

Either way we should be closing in on some big moves upward for TVIX. It's been a long slog in this king+rook vs. king match but victory is within sight as long as I don't get complacent. I am now loaded to the gills on TVIX waiting for that day when the DJIA just breaks down in tears and keeps falling and falling and taking out stops like an elephant in a china shop. You know, that 300-500 point down day that I have been talking about for months now. It's coming. It will bring the fear. A break below that orange line means I can lighten up a little for now, just setting stops above it. But another bounce to the top of the channel means running for cover again as I have done so many times up until now in order to avoid being gored by this bull while ratcheting down my cost basis each time. Time will tell how this strategy works out.

No comments:

Post a Comment