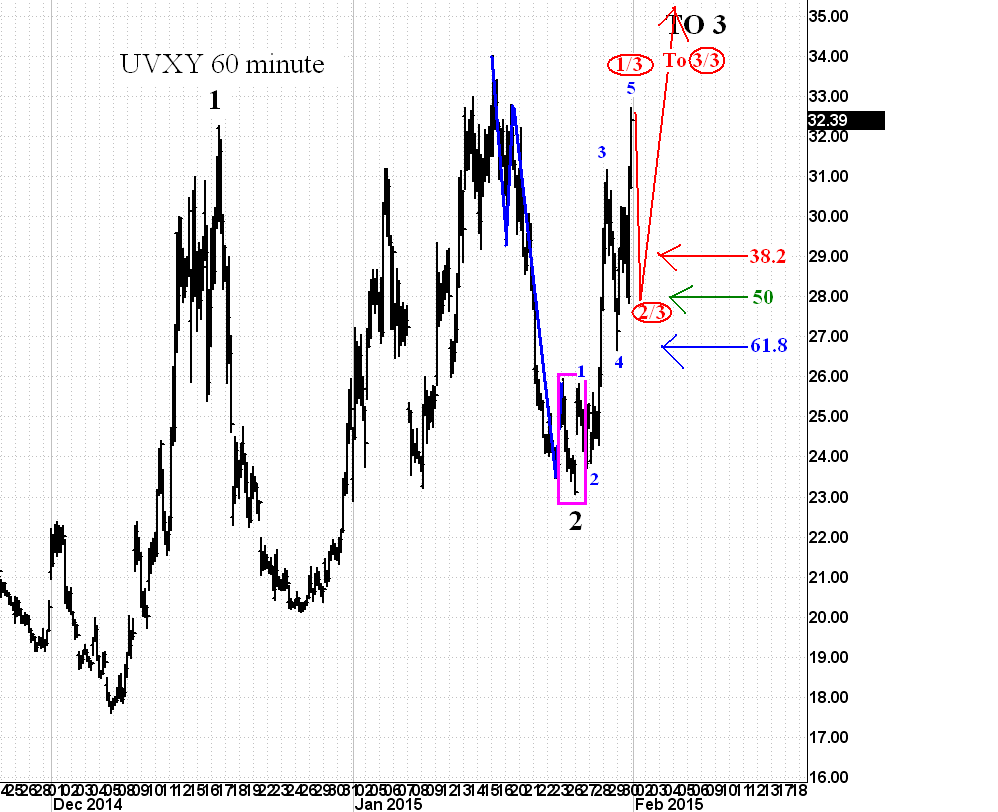

As you can see from Friday's close, the threat did play out but only down to $23 instead of $22. While $2 is 6-7% on this stock at this price, saving that $2 by anticipating this down thrust was not my primary goal (but I still pocketed the cash...). The primary goal was to see 5 clear waves down because that was supposed to be C of 2 and C waves are generally easy to read. If I had not seen that little final dip then I would be looking around wondering what direction the impact would be coming from. But seeing that dip and the subsequent rapid rise (50% in just a couple days ain't bad!) gives me more confidence that the current count is correct.

By the way, what TA do you know that could have predicted that green wave up like that? Folks, EW is the only market timing technology that has even a remote prayer of doing that. No other TA has that potential level of granularity, not even close. Of course, it's all about odds and not certainties but you have to admit, the odds have been with us of late on these counts.

But since we did just get a massive rise we have to be careful of the retracement because this could be more than $2. If my count is right then we should expect no less than the 50 fib retracement @ about $29 and that would be best case. More realistically with something this wild we might see the 50 fib play out. Use stop folks. Be a money ratchet. Let the retracements happen without you eating them.

Right now we are seeing higher lows and higher highs so it is possible that UVXY spikes to $34 or even $35 before pulling back. If we get a small AM pullback then then a move to ~35 in 5 waves then be wary of the big a-b-c that could be ready to slam newcomers to UVXY in the face. If you are new to the blog then I recommend you do not chase! Start by buying the significant pullback. Remember, there is no such thing as all trains have left the station. There is always a bull market somewhere. That means you should never buy unless it is because of an EW-predicted pullback. If that happens then you know exactly what to set your stops to. If not then play like a surfer and wait for the next good wave! It's more important not to lose money than it is to win some.

Right now we are seeing higher lows and higher highs so it is possible that UVXY spikes to $34 or even $35 before pulling back. If we get a small AM pullback then then a move to ~35 in 5 waves then be wary of the big a-b-c that could be ready to slam newcomers to UVXY in the face. If you are new to the blog then I recommend you do not chase! Start by buying the significant pullback. Remember, there is no such thing as all trains have left the station. There is always a bull market somewhere. That means you should never buy unless it is because of an EW-predicted pullback. If that happens then you know exactly what to set your stops to. If not then play like a surfer and wait for the next good wave! It's more important not to lose money than it is to win some.

No comments:

Post a Comment