Metals are extremely oversold right now according to sentiment indicators but that only suggests that some kind of significant bottom is near, not that one is in place. As the old market saying goes, markets can stay irrational longer than you can stay solvent.

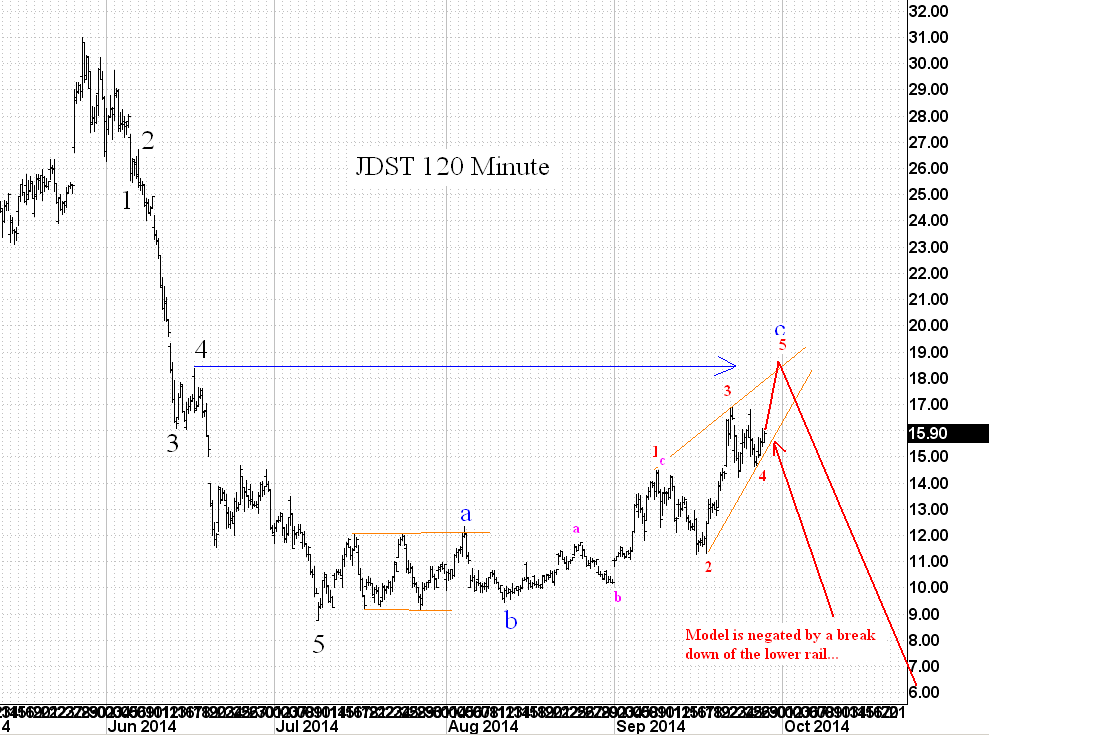

A good combination of tools is the wave count plus the sentiment indicators. My best wave count for metals is shown below in the form of JDST - the triple leveraged junior miner short ETF. It suggests that after a 5 wave gold rally that ended July 2014, JDST (like any other thing which has just had a downward EW 5 wave impulse) deserved a relief rally. That should come in the form of an a-b-c move which, it seems to me, would make perfect sense to end in a rising wedge as shown. Why? Because per my oft quoted proprietary observation/indicator, 3rds and Cs often end in rising wedges. Also, a 5th wave of that wedge would take JDST back to the level of the prior 4th wave which is something else we should be looking for in the rebound.

If JDST breaks the top rail of that rising wedge and then comes back down insides as I think it will, I might just be tempted to put all of my trading cash into JNUG because the snap back rally is going to be serious. It will either form E of 4 or possibly even B of C of the entire metals bear since silver was $50 and gold was $1900 per ozt. Either way, the rally would be spectacular with hundreds of percent easily at stake from the JNUG lows.

Fear and Discipline and Patience will reward M+M traders. My only hope is that the DJIA crashes a little before wave blue C of the chart below so that I can take TVIX profits and move them into JNUG at or about the time when JDST hits $18.50 or $19.

Friday, September 26, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment