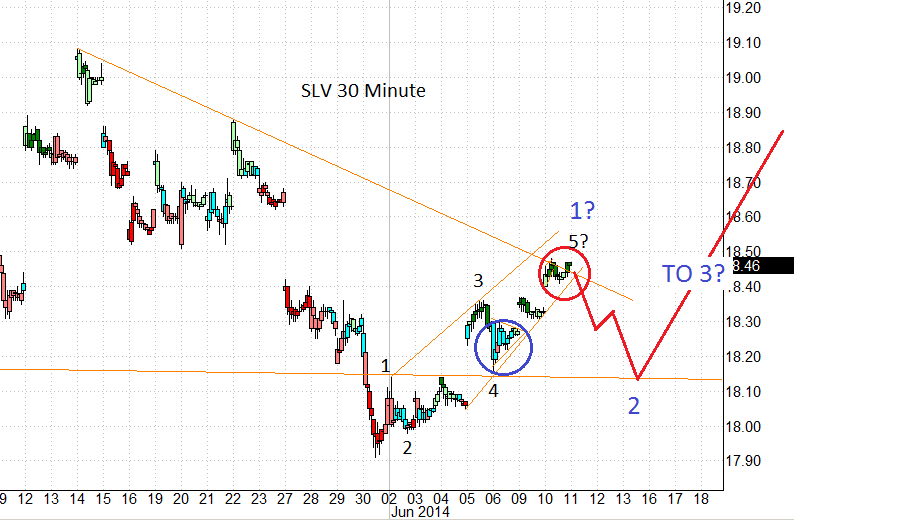

In any case, today's big 10+% run in JNUG into the close was just too tempting and so I locked in profits right at the close. While it may not start tomorrow, the silver rally has been running for enough days now that I think it could be looking for a breather. I'm pretty sure we are working on a small 5th wave because of the triangle circled in blue. What I'm not sure about is whether the part circled in red is a 5th wave double top or if it was just 3of 5 and 4 of 5. If it breaks to a higher high at the open tomorrow I will probably trade back in but with a tight leash.

Of course, unless you have millions to throw around, silver metal is boring. Tiny moves in the metals can cause the junior miners to move quickly and when you triple the action using an ETF like JNUG/JDST then it can be very sporty in either direction. I'm hoping for an a-b-c pullback to buy back into JNUG but if it shows strength in the AM I'll probably jump back in, again with an eye toward pulling the rip cord again if it shows weakness.

Gold is still bound by its center channel. It broke out during its 3rd wave (naturally) and then broke back down below since then and has been riding it up from below. I hope for the blue path but a gap up tomorrow could take us on the red one. The sideways action seen in the current wave is often treated as a flag with AM gaps. This past one could count as 4 of 5 of 5 of small 1.

No comments:

Post a Comment