I've expressed my opinion in these pages many times that GE is a massively leveraged shadow bank posing as an industrial conglomerate. Their debt:cash ratio ($380bn debt : $11.6bn cash at the time of this writing = 32.75:1 leverage) is ridiculous for a company of GEs maturity. Furthermore, where did much of that debt come from? I believe that it is due to GE's vendor finance operations. While supposedly legit and totally legal, I personally consider all vendor financing a scam. This is a situation where non-credit worthy customers who cannot obtain bank financing for GEs products on their own actually get loans from GE to buy the stuff. I believe that GE uses its good name to vouch for loans for itself and then it takes this money and re-loans it out to its less credit worthy customers who thus circumvent the borrowing restrictions that a normal bank would have imposed upon them. GE is not alone in this but it has been a huge shadow bank player. I think vendor finance, in general, can be fairly classified as a scam. I think that any vendor financed sales should not be counted as sales until the loan is repaid. Of course, the pump and dumpers don't like that kind of honesty.

The banks have these restrictions for good reason: higher interest rates compensate them for the risk of loaning money to risky enterprise. In many cases, the banks might not loan the money at all after accessing the risk. But GE wants to makes its "sales" numbers look good so that the CEO and other corporate con men can cash in big on their stock options and bonus program. So they will sell to anyone who wants to buy under "no cash? no problem!!" terms as they loan their customers the money to "buy" their stuff. Note: this is my my investment thesis and my personal opinion, not an accusation against GE or its officers. I have no evidence to prove anything I write here.

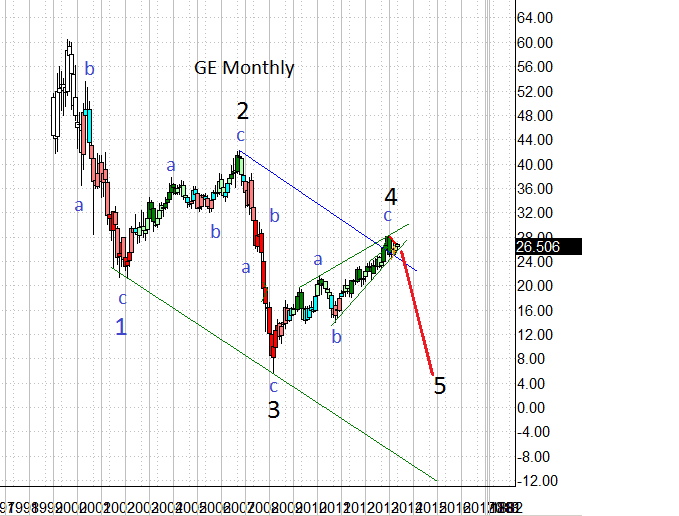

Having said that, I think the GE chart is really ready to roll over and so I finally took the step of buying some leaps-puts against it. I purchased 50 contracts of the Jan 2016 $13 GE puts (GE_011516P13) @ $0.15. The last time I placed this type of ultrashort 2 year deep out of the money put options bet it was against AIG when it was still trading in the 40s. I ended up closing out my position for 66x my purchase price. I think that GE will trade sub $5 in the next 2-3 years and there is a nonzero chance that it will even be broken up or BK.

The chart is now sporting a declining double top just a small amount above the trend line which is parallel to the 1-3 line. I had expected the chart to top out about $1 ago but only now that I model the DJIA as having peaked was I willing to place a leveraged bet. The first breakdown confirmation would be a break back below the blue line into the channel. It would be especially convincing if this happened with gusto and heightened trading volume. I want to see a bit of herd panic here in order to seal the deal.

Zooming into the weekly chart, I think waves 1 and 2 down of the new bear market for GE have already played out and that we are now looking at the imminent beginning of a 3rd wave down which should gap down below the next two major support lines (the up-sloping green line and the down sloping blue line). It really requires the power of a 3rd wave to take these significant support levels out and so it should not surprise anyone that wave 1 down bounced off the blue support line but then was unable to make a higher high. This is very typical behavior. The 1st wave takes a shot at it, fails and retreats and regroups into a 2nd wave and then comes back with full overpowering force as the 3rd wave unfolds.

My primary model is the red model. My secondary model is that only wave 1 of 5 is complete. If the blue model plays out it should kiss or throw over the top green line within 2 weeks. I just don't see that happening at this point which is why I decided to buy the put contracts. Time will tell.

Thursday, May 15, 2014

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment