Using my EW chart model I bought into BLDP at 85 cents just a few

weeks ago. I think they have hit a long term bottom. They have

a lot of IP and products in the fuel cell space but I view them as a natural gas play for transportation and distributed energy generation. Fuel cells convert hydrogen into electricity with about 60% efficiency. But hydrogen is not a commodity in our economy so natural gas is "reformed" into hydrogen on the vehicle with approximately 80% efficiency. That means that you have a 45-50% efficient conversion of natural gas into electricity which is pretty good if that is what you want to use it for. If your goal is to power a vehicle, electric motors used for cars are 90+% efficient. Bottom line, natural gas efficiency for use in transportation is .80 x .45 x .90 = ~.32 or 32% efficient. Compare that to internal combustion engine efficiency of 19-25%.

The US has trillions of cubic feet of natural gas that are easy to get to. In fact, we have so much of it that the price is very low right now and we are just burning it off as a waste product from the Bakken oil fields because it is not economical for them to bring it to market at current prices (what a shame...).

I believe that what will cause Ballard to really take off again is

when we start using all of our natural gas reserves as transportation and

electricity generation fuel instead of mainly for heating and cooking. I think the advent of the electric car will

eventually drive that. Tesla Motors is proving

that electric cars don’t have to be punishment vehicles. By having paid back their federal loan they are proving that they are not a flash in the pan. Tesla electric cars are real. But their current flagship car only has a

range of 200 miles and that is when it’s brand new. Battery technology is such that it will only

have 120 mile range in a couple years and need a battery pack replacement in

5-6 years.

I suspect that a major drivers of the rethink about using fuel cell based vehicles will be (listed in order of importance):

- the lack of longevity of battery packs. People need their drive trains to last 10+ years with the real possibility of 15 years or more, not the guaranteed need of battery replacement in 6-8 years with rapidly declining performance (read driving range) in the last 25% of life.

- the fragility of the battery packs. Using them in high heat areas like AZ and TX significantly reduces their output and their longevity. We are seeing data that show significant degradation in as little as 2 years with complete failure in 4 years in high heat environments. Battery packs HATE heat.

- The cost of battery pack replacement is far higher than changing an internal combustion engine. There is also the real threat of being assessed an environmental impact charge to dispose of the battery when it is spent.

- The driving range of battery packs and refueling times relative to natural gas based refueling of fuel cells.

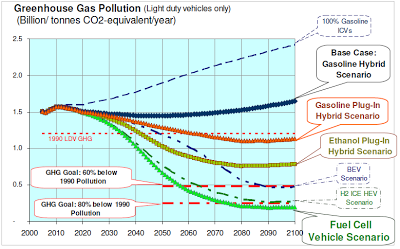

- Green house gas (GHG) generation. Per the chart below, the fuel cell vehicle is the best option for this. Not that I think that human based GHG emission is causing global warming. I don't. I think the Earth goes through natural cycles that are probably more related to activity within the Earth's core or due to changes in the sun. But government wants to key in on GHG as a taxation mechanism with the sale of so called "carbon credits". This is coming because government is greedy, relentless and manipulative. It needs more taxation in order to maintain its ridiculous size and power. So I think this has to be factored into the equation.

instead of a simple battery pack replacement, many of these cars could receive fuel cell stacks and be converted to natural gas operation using onboard natural gas to hydrogen converters (call "reformers").

Having said all that, this is a small money play IMVHO. It's a good place to think about parking $500 or $1000 and then watching the chart for good exit points. In this crazy market that could take 6 months or 3 years.

As usual, this blog post is provided in the name of financial entertainment only and it is worth exactly what you paid to read it. Do your own research and make your own decisions.

1 comment:

The efficiency of a Diesel engine is typically in the 30s and the best ones near 40%. More recent gas engines have also reached 30%. Not considering the convenience of liquid fuels over natural gas that makes its transportation and distribution more efficient.

So I wouldn't bet on fuel cells being used for transportation so soon, though it potentially has more upwards room than IC engines. The battle is still at the foot of the hill for electric cars, which will surely carve a space in the market, but not a dominance as long as batteries that take hours to charge are used.

What I am really interested about fuel-cells is as a distributed stationary power source, such as for homes and buildings. Though it might be uncompetitive when compared with subsidized and massive utilities, in remote locations, where the cost of power-lines and sub-stations might be significant to a community, it might prove to be a viable alternative for individual homes and small businesses, e.g., a dairy or a grain elevator. And the US is peppered with small, rural towns...

Post a Comment