After the stock market initially began crashing in late 2007 and all though 2008, John thought that we were going to have a "muddle through" economy. In other words, things would get better but it would be sort of slow and annoying. He never really believed that a serious global crash was in the cards in those days. As time went on he began to change his tune. His new book - just released - based on his new realization is called "End Game". End Game is not "Muddle Through" - John has changed his views on what is coming.

As you can see from this early 2010 video he was already formulating his thoughts for the book at that time. It is a fairly slow moving video but its well worth your time to watch anyway if you still haven't figured out that something dramatic has got to happen to the global economy in the next few years. We have a global debt Ponzi in the end stages and Ponzis always end up collapsing.

The problem is completely simple: everyone, and I mean everyone in the world is neck deep in debt. Even the people who act like they have a surplus are really in debt even if they don't get it yet. How can that be? Well, imagine that you make products and I buy them from you. I don't have the money to pay so you loan it to me so that I can buy. I buy a lot of your products like this so you took out big loans in order to buy manufacturing capacity to produce lots of products to sell me so you could get rich quick.

Unfortunately, I don't have the cash to pay you for the products. I owe you the money and I have owed you the money for decades. At this point you are afraid that if you cut me off that you will be out of a job. As a result you keep producing products and giving them to me and taking IOUs in exchange.

Now, if I ever had the ability to pay you, I would have done it years ago. Each year that goes by I pile up more debt. Do you think I'm ever going to pay you? No, I never will. Not because I don't want to but because I don't have the ability to. Of course, I have gotten used to having all your nice products without paying for them. I have come to think that everything I consume each day is my birthright. It has become so natural for me that I don't even think about it anymore and I certainly don't worry about repaying you.

At some point you are going to have to accept the fact that I am a deadbeat and that you have been a greedy fool trying to sell someone like me more products each year even though it has been clear for years that I don't intend to pay up. When you accept that fact you are going to stop sending me products. Up until this point, you have been telling your parents you are rich because I owe you so much money. You have been treating a Wimpy Promise as if it were cash. At times like this, two birds in the bush does not equal one bird in the hand. When you do cut me off then how are you going to pay the debt on all that manufacturing capacity that you put in place trying to make bank on my over consumption?

And so it is clear. Even the overproducers that everyone considers rich like

All we are waiting for is some catalyst before it all topples over in a loud crash. What we think of as normal in the

I'll leave you with the final thought on a couple of charts starting with the Dow Jones Industrial Average. Look at this chart which goes back to around 1929. You see that exponential "hockey stick" curve? No properly functioning economic system can have that type of growth because the growth should be based on work and people have not worked exponentially harder or more productive since 1980 when the chart went wild. That chart is due to credit growth, not real economic growth.

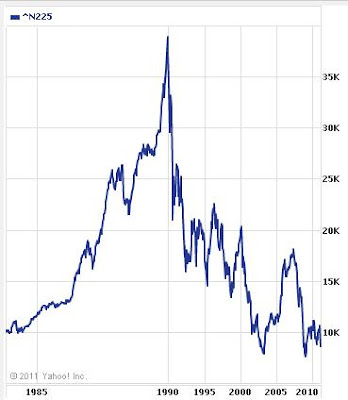

Now that credit is collapsing, guess what the Dow is eventually going to look like? Well, it will probably look a lot like the Japanese stock market since they entered a multi-decade deflationary crash. This chart which is shown below using the Nikkei 255 (sort of like the DJIA of Japan) is known as a mania chart. There are many in history including things like Tulip Mania of the 1600s, the South Sea Trading Bubble. etc. Whenever you have that exponential left hand side you have to expect an eventual reversion to the mean and probably an undershoot by some degree.

So here we are in the End Game. People keep talking about cutting the government spending but that is exactly what will trigger a deflationary crash. We HAVE to continue borrowing and spending ever higher amounts. If that ever stops then we will begin the slide down the right hand side of the mania collapse. The sooner we all realize this and take the pain the better off we are going to be. But if we try to forestall the inevitable forever then it is going to bleed us slowly before the collapse happens. The best move is to allow the collapse to happen quickly and then begin working toward a new stasis while we still have a lot of fat on our collective economic bones. Think of it like getting heart surgery. You know your heart is giving out and that surgery will eventually be required. Should you do it now while you are strong or wait until you are weak and feeble to go under the knife? It really is just about the same thing with the economy. Smart people will use the time leading to the collapse to try to get themselves as well positioned as possible. Well positioned means "as far away from the debt Ponzi as possible". Here are some specific actions can you take to get there:

- Get your long term savings out of debt based money like the dollar and other fiat currencies. Put it into real money like gold and silver. Don't do it all at once, convert your savings into real money over time (AKA dollar cost averaging). 10 or 20 years from now you will still have your buying power if you stored it in real money. If you store it in fake money like dollars or other fiat currencies you will eventually lose the vast majority of your buying power. $1,000,000 will spend like $100,000 or maybe even $10,000.

- The stock market is a Ponzi scheme. 401ks and IRAs and any other savings plans where government controls your access to your own money are TRAPS. All of them. Why do you think they put the bait of tax deferral in there like that? Because they like you? HA! HA! HA! Please don't tell me you think the government gives two $hits about you after the way they ripped us off bailing out their banking and finance pals! The tax deferral is nothing more than bait. Government knows that you have to bait a trap if you want to catch any game. Save for your retirement but avoid tax deferred programs which give control of your retirement fund to the government. Unless you have your money in your hands, you don't really have your money. "They" have it. And when push comes to shove, they will steal it just like

Argentina - Don't assume that all the nice things that are available to us will always be available. Folks, we are not paying for all the imports and so at some point the imports we are not paying for must stop.

- Don't count on government to save you. Americans need to work our way back towards the fierce independence exhibited by early Americans. Government has no money of its own and it will have increasing problems asking me and other people for more of our money to spend on its projects. I don't get anything I want from government spending at this point so I am not happy giving them more of my money. I know a lot of people who think the same way. Many of them now call themselves "Tea Party" members. I do not call myself a Tea Party member because it has too many fake posers like Sarah Palin associated with it for me to want to affiliate myself with it.

- Don't count on world class infrastructure in this country forever. Our infrastructure is expensive and we paid for it with credit. As the credit runs out we will find that maintaining big roads, bridges, underground pipes, etc. is very expensive and in fact more than we can afford. When your cable TV starts to get glitchy, your electricity seems to be having brown outs where you never used to have them, you start getting lots of boil water orders due to broken pipes, etc. then that is a sign that infrastructure maintenance is being neglected because it's just too expensive.