I don't know when the herd will decide to panic. I don't know the day or the hour but it will likely be when people least expect it. Market optimism, or said differently, complacency is at all time highs. It has caused everyone and their brother to borrow money to get in on the Ponzi at a time when they should be heading for the door. The latest and perhaps greatest bear to get killed was Dennis Gartman who went into a big mea culpa for being bearish or not bullish enough while stocks have climbed and climbed despite the fact that he knows it is all a big unsustainable debt Ponzi. The market has now given the impression that fundamentals no longer matter when in fact they always have and always will. It's just the meddling by government which has given the impression that the laws of economics no longer apply. It is akin to the 1929-32 Pompous Prognostications that I have posted to these pages several times. We have reached a magical peak, a plateau of permanent prosperity for anyone gambling in the markets. So go ahead and leverage up all you want because there is no downside now that the federal reserve is controlling things.

That is the new thinking. Of course, it is not new thinking. It is the same old herd-think that is part of every boom and bust that ever was. It is the same thing thing that all of the pilots of the Blue Angels flying team are thinking just before they all auger into the ground in a fiery ball. There is nothing new under the sun, folks, nothing is new except the history that you don't know. This has played out so many times before. People begin to believe in something for nothing and for a time they seem to receive it. But then when they go to collect it, that something turns out to be the nothing that it really was all along. This is the nature of any Ponzi scheme and no it's not going to be different this time.

Those who are early in calling it, like me, get the eye roll. But I would rather know this early and be looking for it in real time then to not understand it and say "I never saw it coming" when it finally does hit because there will be no time to get out one the collapse begins. It is guaranteed to end badly.

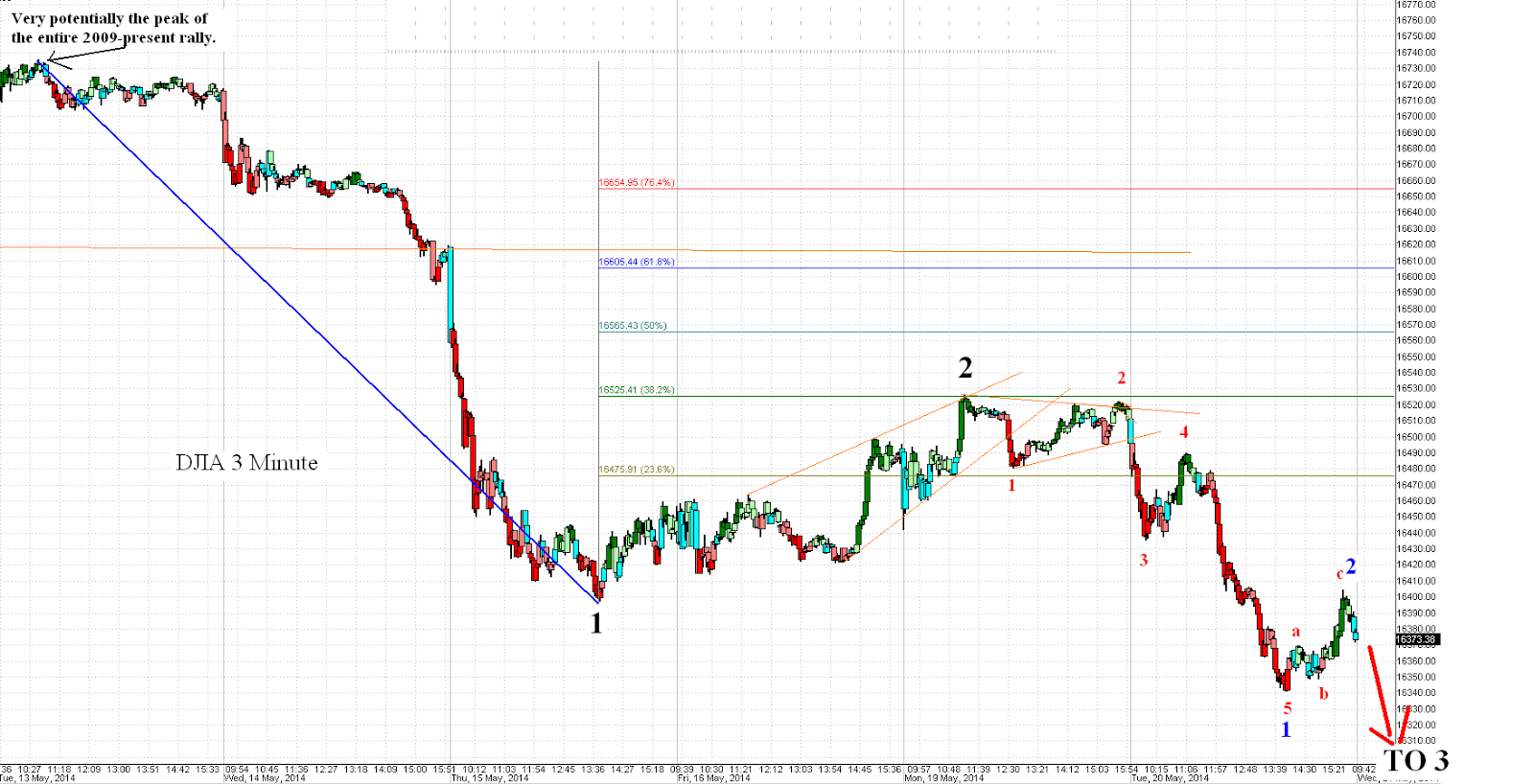

One of the signs of the overoptimism is the lack of insurance against leveraged bets to the long side: the so called VIX fear indicator. Today I want to highlight the chart of the SVXY ETF which tracks the inverse of the daily moves short term VIX futures. So, as VIX (AKA fear) goes down, SVXY goes up. Manias often increase 10x before the herd decides to abandon them. Note how this was ~$8 in late 2011 and is now nearly $80 while tracing out the 5th of 5 and also skyrocketing up in an exponential fashion to the top of its channel. Notice the triangle at the start of the chart segment between 4 and 5. All of these technical indicators are screaming "Get the fuck out" at the top of their lungs. Take this in conjunction with loss of confidence in the ruling elite both in Europe and in the US and you have the makings of a major, major market collapse.

So when will it happen? Clearly, when it is least expected. What

will be the catalyst? Clearly, something will happen that will seem

minor but then for unexplained reasons it will spiral out of control.

People will blame that one thing but it will not be the real cause. The

real cause has been building for decades and has been rising

exponentially for several years: a credit pumped system will always at

some point reach an end point whereby the banks can't lend and the

borrowers stop wanting to borrow. It would not surprise me to see what I call the race horse syndrome take place. That is where you have a high strung race horse and there are all kinds of distractions to him all the time: loud taking, perhaps yelling, the pop of starter's guns going off, etc. But the horse always seems to handle it. But then for some unknown reason, the horse get a minor fly bite or bee sting in the ass and then just loses it. People blame the insect bite but the horse has been fine under worse circumstances before. So it is not rally the bee sting per se but rather the accumulation over time. The last straw on the camel is another analogy but in that case the camel just lays down. I expect in this case the race horse will go crazy wild with kicking and running and slamming about to the point where it becomes a great danger to property, anyone standing near it and even itself.

Of course, it could also be something more mundane such as another collapse in housing data coming in June. Bad weather will not

be able to be blamed again. Keep in mind what Greenspan taught us: there can be no recovery without participation from the housing market.

This is because housing is one of the biggest asset classes that is

almost elusively paid for with debt and when people stop taking on debt,

the debt Ponzi begins to unwind. The Ponzi needs ever increasing

prices and it needs people to take on ever increasing amounts of debt to

buy things.

Trees don't grow to the sky folks. If you

or your loved ones live in a place where an average home costs north of

$250K then you should strongly consider getting out right now because

when this credit collapse is over there will be another huge glut of

foreclosures on the market that will kill housing prices (and the banks

who stupidly loaned the money to buy them). You think the financial crisis of 2007-2009 is over just because the federal reserve threw everything it had at the problem and everything that all global governments had? Think again. All they did was rack up more debt and that was never the final answer to an insolvency problem. In other words, you cannot forever avoid bankruptcy simply by taking on more debt and that is the only thing that has happened since 2009.

Saturday, May 31, 2014

Nigel Farage and UKIP take control of the UK representation to the EU.

In the EU they have been voting on who will control things. The EU is a socialist organization which has been running things using ever expanding credit since its inception. Nigel Farage has been an outspoken opponent of this socialist takeover of Europe and is the head of UKIP (UK Independence Party), AKA "Euroskeptics". Euro whistle blowers is more like it and this is evident in all of the outstanding videos of Mr Farage speaking at meetings of the MEPs (Ministers of European Parliament) which controls the EU. Go to Youtube and look him up if you want some real laughs because he pulls no punches whatsoever when addressing other members of the EU ruling body. He points out that they are just a bunch of dangerous power mongers that don't give a crap about anything or anyone except using debt increases in order to retain control.

Just a few years ago, when the credit was flowing, everyone dismissed Farage as a lunatic fringe player. Of course, that was to be expected as long as the credit was growing. But now that the global money supply is contracting and now that the people are getting affected by it, their empty stomachs and dwindling bank accounts have got them paying more attention to conservatives like Farage. All of a sudden he's not the laughing stock of the con men running the show. All of a sudden he's got momentum. This is the con man socialist politician's worst nightmare. It shows that they are losing the confidence of their somnambulant Marks and Patsies. And in a con game, loss of confidence is loss of control.

This is just another sign of what I have declared to be true in these pages: an accelerating shift away from liberalism and a new and growing conservatism movement. I am confident that at some point it will result in at least a partial break up of the EU. The trend will push back from globalism and will focus more on nationalism and self sufficiency. The vendor finance export model will take a punch in the gut and it will badly hurt players like France, Germany, Japan and China. People will make do with less externally manufactured products and begin a new era of self reliance. I expect that the liberals in the US will take a big step downward in coming elections as well. A great restructuring is upon us and not all of it will be orderly (to say the least).

Just a few years ago, when the credit was flowing, everyone dismissed Farage as a lunatic fringe player. Of course, that was to be expected as long as the credit was growing. But now that the global money supply is contracting and now that the people are getting affected by it, their empty stomachs and dwindling bank accounts have got them paying more attention to conservatives like Farage. All of a sudden he's not the laughing stock of the con men running the show. All of a sudden he's got momentum. This is the con man socialist politician's worst nightmare. It shows that they are losing the confidence of their somnambulant Marks and Patsies. And in a con game, loss of confidence is loss of control.

This is just another sign of what I have declared to be true in these pages: an accelerating shift away from liberalism and a new and growing conservatism movement. I am confident that at some point it will result in at least a partial break up of the EU. The trend will push back from globalism and will focus more on nationalism and self sufficiency. The vendor finance export model will take a punch in the gut and it will badly hurt players like France, Germany, Japan and China. People will make do with less externally manufactured products and begin a new era of self reliance. I expect that the liberals in the US will take a big step downward in coming elections as well. A great restructuring is upon us and not all of it will be orderly (to say the least).

Obama thinks that changing the mouthpiece will change the public's view of him and government.

Jay Carney is leaving the coveted position as White House Press Secretary. This position is normally highly sought after because it is a gateway job. In other words, after you leave in good graces, doors open up for you. Highly lucrative doors. Just ask Dana Perino, the bumble headed blond bimbo beauty queen Press Secretary of the Bush Administration. To be fair to ms Perino, she is a good deal smarter than her performances during the Bush years would leave one to believe. She appeared to be a complete idiot at times mainly because the script which she was handed to recite was ridiculous. But she muddled through and is now worth a cool $4 million.

The circumstances of Mr Carney's departure assures that he will not be afforded such opportunity. He is reportedly leaving because of the strain that the position has put on his family. Well this is an old story. Any time you hear about someone leaving a good job "for family reasons" or "to spend more time with family" you can be sure they are taking the fall, whether deserved or not, for how things are going for the powers that control them at the present time. Carney is out not for doing a poor job but simply because the social mood is headed south and the administration thinks that a change in marketing strategy of their scam will help. They think they can bolster confidence by rolling a few public heads. They are badly mistaken about this. Confidence is shot and in a con game that is everything. Confidence will continue to break down making the final 2 years of the Obama disaster the worst years any president ever spent in office.

All of this is right in line with my main theme which is that peak credit has occurred and that the herd is now turning away from stupid money-driven optimism and political correctness. Unfortunately, the herd will not just revert to the mean. We have over shot to the high side by a record amount and now there will be a long period - years in fact - of overshooting to the down side. It will affect everything. You don't get an 100 year pump (the federal reserve was created in 1913) without a significant dump. You can't have an exponential Ponzi without a corresponding collapse. This is the problem I have written about many times that is enabled by fiat currency and especially fractional reserve lending. Those who are part of the pump essentially steal some of the prosperity of the later generations. After credit has peaked it can only go down which means less money in the money supply for those who follow. That means less opportunity even for the best and brightest to come. And it certainly means a smaller middle class and a wider gap between the haves and the have nots. This schism will lead to civil unrest and yes, violence on a significant scale.

Here are a few more articles worth your time:

On returning to the gold standard.

Social and market impacts (scroll all the way down to this section if you are short on time):

"Social and Stock Market Impacts

Peak credit has been surpassed, but a substantial portion of the rise in credit is in the form of student loans that cannot and will not be paid back.

Importantly, millennial attitudes towards cars and other material goods is not the same as their parents. Moreover, student debt and a dearth of high-paying jobs ensures that housing formation will stay depressed, even if attitudes did not change.

As boomers retire, they will need to draw down on both their stock market portfolios and their savings (assuming they have either). Economic support from relatively low-paid millennials so that boomers can maintain their lifestyles will be massive.

Millennials will assist aging boomers via taxation and by overpaying for Obamacare. Higher taxes coupled with increasing time commitments to help care for aging parents will take a toll. And because boomers live longer than ever, the economic drain and time commitment from millennials will increase every year.

This has downward implications on the economy and the markets, especially in light of millennial-mistrust in stocks and the massive amount of student debt many of them carry.

Wall Street is not prepared for the major attitude and demographic shifts that are now underway. Are you?"

I have written about these same points many times:

The circumstances of Mr Carney's departure assures that he will not be afforded such opportunity. He is reportedly leaving because of the strain that the position has put on his family. Well this is an old story. Any time you hear about someone leaving a good job "for family reasons" or "to spend more time with family" you can be sure they are taking the fall, whether deserved or not, for how things are going for the powers that control them at the present time. Carney is out not for doing a poor job but simply because the social mood is headed south and the administration thinks that a change in marketing strategy of their scam will help. They think they can bolster confidence by rolling a few public heads. They are badly mistaken about this. Confidence is shot and in a con game that is everything. Confidence will continue to break down making the final 2 years of the Obama disaster the worst years any president ever spent in office.

All of this is right in line with my main theme which is that peak credit has occurred and that the herd is now turning away from stupid money-driven optimism and political correctness. Unfortunately, the herd will not just revert to the mean. We have over shot to the high side by a record amount and now there will be a long period - years in fact - of overshooting to the down side. It will affect everything. You don't get an 100 year pump (the federal reserve was created in 1913) without a significant dump. You can't have an exponential Ponzi without a corresponding collapse. This is the problem I have written about many times that is enabled by fiat currency and especially fractional reserve lending. Those who are part of the pump essentially steal some of the prosperity of the later generations. After credit has peaked it can only go down which means less money in the money supply for those who follow. That means less opportunity even for the best and brightest to come. And it certainly means a smaller middle class and a wider gap between the haves and the have nots. This schism will lead to civil unrest and yes, violence on a significant scale.

Here are a few more articles worth your time:

On returning to the gold standard.

Social and market impacts (scroll all the way down to this section if you are short on time):

"Social and Stock Market Impacts

Peak credit has been surpassed, but a substantial portion of the rise in credit is in the form of student loans that cannot and will not be paid back.

Importantly, millennial attitudes towards cars and other material goods is not the same as their parents. Moreover, student debt and a dearth of high-paying jobs ensures that housing formation will stay depressed, even if attitudes did not change.

As boomers retire, they will need to draw down on both their stock market portfolios and their savings (assuming they have either). Economic support from relatively low-paid millennials so that boomers can maintain their lifestyles will be massive.

Millennials will assist aging boomers via taxation and by overpaying for Obamacare. Higher taxes coupled with increasing time commitments to help care for aging parents will take a toll. And because boomers live longer than ever, the economic drain and time commitment from millennials will increase every year.

This has downward implications on the economy and the markets, especially in light of millennial-mistrust in stocks and the massive amount of student debt many of them carry.

Wall Street is not prepared for the major attitude and demographic shifts that are now underway. Are you?"

I have written about these same points many times:

- peak credit

- boomers retiring means market withdrawals at a time when young people are not putting monty into the system

- Not stated above but I will add it: the government has been making up for this delta by enabling vast amounts of low cost credit to be used to pump the markets. They hope that this fake prosperity will trick young people into jumping onto the band wagon for fear of being left behind. But young people have given up on the government and on the bankers and on the markets. They now see it as all too expensive to spend what little money they are making on. And of course, I'm referring to those that have jobs at a time when many are deciding that the green paper they would receive in return for their labor simply isn't worth it anymore.

Friday, May 30, 2014

TRX update - critical technical juncture

In my Memorial Day post on TRX I cautioned that

Per today's chart below, the lower rail has been broken down an now the chart is at a critical juncture. It must either decide to break back up into the channel and then break out the top channel or this could be viewed as a kiss good bye of the lower rail leading to lower prices. I can't predict the future and neither can anyone else. But by setting triggers and sticking to them we can increase our odds in this big casino where many of the games seem to be fixed by the house. TRX must break back up into that channel and soon or confidence will be lost. A break below the prior low is obviously a sell signal and we are not far from it.

The potential for an inclining double bottom still exists here but don't fight the ticker if that throw under cannot break back up into the channel. If it falls back to $1.68 or lower then chances quickly fade that a breakout is going to happen. Ending diagonals usually end with a vee bottom indicating panic selling and capitulation and this chart is not doing that.

- the a-b-c which I was expecting into wave 2 was now more than 3 waves.

- it could morph into an ending diagonal for wave 2.

Per today's chart below, the lower rail has been broken down an now the chart is at a critical juncture. It must either decide to break back up into the channel and then break out the top channel or this could be viewed as a kiss good bye of the lower rail leading to lower prices. I can't predict the future and neither can anyone else. But by setting triggers and sticking to them we can increase our odds in this big casino where many of the games seem to be fixed by the house. TRX must break back up into that channel and soon or confidence will be lost. A break below the prior low is obviously a sell signal and we are not far from it.

The potential for an inclining double bottom still exists here but don't fight the ticker if that throw under cannot break back up into the channel. If it falls back to $1.68 or lower then chances quickly fade that a breakout is going to happen. Ending diagonals usually end with a vee bottom indicating panic selling and capitulation and this chart is not doing that.

The fear in metals and miners is that already ridiculously low metals prices can get ridiculously lower. For example, if the silver chart turns out to be an ending diagonal per the model below (a possibility I have discussed many times before in these pages), then each of the waves should be a-b-c in nature. You can see this in the transition between 1 to 2, clearly see it again between 2 to 3, again in 3-4. Each of these is supposed to be 5-3-5. That includes the transition from 4 to 5. But if we look at the chart, it seems that we had 5 waves down to the bottom of the channel. What if this was just A? Furthering this position is the a-b-c back up which could have formed B. If this is true then we are just starting for form C. At this point the trend is still down and so that has to be respected. If the chart can break back up into the channel soon then more thought would be called for but until it does, the safe play is to watch for signs that C is playing out. If that turns out to be the case, conserve cash and wait for the 5 waves down to finish and then get greedy about jumping into JNUG. Metals are not going to zero. Miners are not going to zero. Dividend payers will always be worth something.

Thursday, May 29, 2014

Trader's alert: Buy BBRY.

I first mentioned BBRY (formally Research In Motion, ticker RIMM) in these pages back in mid December 2013. The shares were trading at $6 at the time. As you can see from the recent chart, the shares then went on to nearly double from that point. However, knowing that nothing goes straight up or straight down, I modeled in this post that I expected a pullback to $7. While I was early in that call, the shares have indeed now pulled back to $7 and have now likely begun their rapid rise into a 3rd wave up.

Zooming in, I show that 1 of 3 has already played out and then 2 of 3 finished as well. The gap you see within the red circle is just 3 of 1 of 3. The gaps will get bigger as the shorts are forced to cover in a panic by an overwhelming hoard of momo players. The sell trigger is anything lower than $7.20. This is about as good as it gets folks. BBRY is not going to BK and it is not going to be broken up. The new management has cut headcount and is now beginning to build product momentum again. Hear me now and believe me later: the upside on this one can be 10x. Why? Because $70 was the level of the prior 4th of course. This thing was once at $235 and there are a lot of short sellers who jumped in on the way down. They all have to cover now.

With expenses now under control, a new focus on customers and on delivering products and $2.5 billion in cash vs only $1.63 billion in debt, price/sales of .56 (that is zero dot five six people) and price/book of only 1.04 (priced for BK when BK is not going to happen), BBRY is very compelling at this level. When the charts and the fundamentals line up like this, you just have to play it.

But play it does mean play it because if the broader markets enter a collapse (which I think is long overdue), then BBRY could be sucked down with everything else. After all, what is a paper asset really worth when there are massive margin calls happening all over the place? Answer: whatever you can get for it. Because of the toppiness of the broader markets we do have to consider the possible downside to BBRY and that could occur in the form of an ending diagonal as shown below. We could just be finishing up the B wave of the a-b-c into wave 5. If this happens I expect a throw under that could take the shares to the $2-$3 range. If you see that, know that it will not last very long. That would be like buying a non-expiring call on a company that has enough cash to last for quite some time. If the chart breaks out of the top orange trend line at any time from here on, the chances are that it has started a new bull market.

Bottom line: buy any time, sell if it breaks down below the trigger level of $7.20 and if that happens look for a trip to the bottom of the channel for your next buying opportunity. Either that or buy a quarter position here and then cost average into a full share if the price goes down significantly. It will not stay down forever.

Zooming in, I show that 1 of 3 has already played out and then 2 of 3 finished as well. The gap you see within the red circle is just 3 of 1 of 3. The gaps will get bigger as the shorts are forced to cover in a panic by an overwhelming hoard of momo players. The sell trigger is anything lower than $7.20. This is about as good as it gets folks. BBRY is not going to BK and it is not going to be broken up. The new management has cut headcount and is now beginning to build product momentum again. Hear me now and believe me later: the upside on this one can be 10x. Why? Because $70 was the level of the prior 4th of course. This thing was once at $235 and there are a lot of short sellers who jumped in on the way down. They all have to cover now.

With expenses now under control, a new focus on customers and on delivering products and $2.5 billion in cash vs only $1.63 billion in debt, price/sales of .56 (that is zero dot five six people) and price/book of only 1.04 (priced for BK when BK is not going to happen), BBRY is very compelling at this level. When the charts and the fundamentals line up like this, you just have to play it.

But play it does mean play it because if the broader markets enter a collapse (which I think is long overdue), then BBRY could be sucked down with everything else. After all, what is a paper asset really worth when there are massive margin calls happening all over the place? Answer: whatever you can get for it. Because of the toppiness of the broader markets we do have to consider the possible downside to BBRY and that could occur in the form of an ending diagonal as shown below. We could just be finishing up the B wave of the a-b-c into wave 5. If this happens I expect a throw under that could take the shares to the $2-$3 range. If you see that, know that it will not last very long. That would be like buying a non-expiring call on a company that has enough cash to last for quite some time. If the chart breaks out of the top orange trend line at any time from here on, the chances are that it has started a new bull market.

Bottom line: buy any time, sell if it breaks down below the trigger level of $7.20 and if that happens look for a trip to the bottom of the channel for your next buying opportunity. Either that or buy a quarter position here and then cost average into a full share if the price goes down significantly. It will not stay down forever.

The chart of greek debt is whispering "get out".... [GREK]

The crash of 2007 through early 2009 was marked by the collapse of the value of debt issued by deadbeat borrowers in the EU. Part of what was done in order to stop the collapse from happening at that time was to issue more guarantees and to lend more money to those who already couldn't repay what they owed. It produced the appearance of normalcy while simply making the coming collapse even bigger than the one that was not allowed to play out before. The big banks are now bigger. The OTC (Over The Counter AKA "unregulated") derivative pile is bigger.

The federal reserve is up to its neck in bad debt and has little room to take on more because the garbage which it already took onto its balance sheet has gasoline costing nearly $4 a gallon in the US. As a result, fast food workers are up in arms about not being able to make a living wage and they are not the only ones. Several states are talking about making the minimum wage $15 an hour. This is exactly what Jim Sinclair warns us about with "cost push inflation". In other words, everyone will begin to notice that the buying power of the greenbacks that they are accepting in exchange for their goods and services just isn't cutting it anymore and so they will demand more. This is historically what happens when central banks dramatically increase the money supply in order to avoid the collapse of problems of their own making. They cannot just continue to print forever because sooner or later the cries of "unfair" and "we need more" turn into "you bastards deserve to die and we have nothing to lose by killing you". Again, I don't advocate violence but this is the lesson of history. It can be communicated plainly or it can be left unsaid but it cannot be changed.

The actions taken over the past 5 years to sweep the problems under the rug have fixed nothing. They have just created bigger problems. This is now being seen in the chart of Greek debt which the ETF GREK is used as a proxy for in the chart below which shows the corrective, a-b-c recovery of Greek bonds since the 2012 low.

My model says that the chart has already broken down and has finished wave 1 of 3 down. It is very nearly finished with 2 of 3. I expect a dramatic downturn soon that will take a lot of sleepy, complacent people by surprise even though there is no mathematical or historical reason not to be fearful about what has been happening in the global economy.

Here is a zoom in of just wave 1 and 2 down. This model suggests that wave 2 will peak within a week or two. If it turns out to be correct, expect news to begin showing up about a new and growing loss of confidence in Euro debt. The European Central Bank cannot handle another bailout and everyone who follows this stuff knows it even if the main stream media seems blissfully unaware. Face it folks, if aliens landed for real, government would not tell you about it even if there were real risks in it for you. Check that. The more real risk in it for you, the less likely they would be to tell you about it. Why? Because of their fear of losing control over you in a stampede. They would say it is for your good that they don't give you warning to protect yourself but that is complete BS. They would withhold the information because they want to protect themselves as long as possible. You would only be told after it was impossible to cover up any further. The collapse of the global debt Ponzi will be no different.

The federal reserve is up to its neck in bad debt and has little room to take on more because the garbage which it already took onto its balance sheet has gasoline costing nearly $4 a gallon in the US. As a result, fast food workers are up in arms about not being able to make a living wage and they are not the only ones. Several states are talking about making the minimum wage $15 an hour. This is exactly what Jim Sinclair warns us about with "cost push inflation". In other words, everyone will begin to notice that the buying power of the greenbacks that they are accepting in exchange for their goods and services just isn't cutting it anymore and so they will demand more. This is historically what happens when central banks dramatically increase the money supply in order to avoid the collapse of problems of their own making. They cannot just continue to print forever because sooner or later the cries of "unfair" and "we need more" turn into "you bastards deserve to die and we have nothing to lose by killing you". Again, I don't advocate violence but this is the lesson of history. It can be communicated plainly or it can be left unsaid but it cannot be changed.

The actions taken over the past 5 years to sweep the problems under the rug have fixed nothing. They have just created bigger problems. This is now being seen in the chart of Greek debt which the ETF GREK is used as a proxy for in the chart below which shows the corrective, a-b-c recovery of Greek bonds since the 2012 low.

My model says that the chart has already broken down and has finished wave 1 of 3 down. It is very nearly finished with 2 of 3. I expect a dramatic downturn soon that will take a lot of sleepy, complacent people by surprise even though there is no mathematical or historical reason not to be fearful about what has been happening in the global economy.

Here is a zoom in of just wave 1 and 2 down. This model suggests that wave 2 will peak within a week or two. If it turns out to be correct, expect news to begin showing up about a new and growing loss of confidence in Euro debt. The European Central Bank cannot handle another bailout and everyone who follows this stuff knows it even if the main stream media seems blissfully unaware. Face it folks, if aliens landed for real, government would not tell you about it even if there were real risks in it for you. Check that. The more real risk in it for you, the less likely they would be to tell you about it. Why? Because of their fear of losing control over you in a stampede. They would say it is for your good that they don't give you warning to protect yourself but that is complete BS. They would withhold the information because they want to protect themselves as long as possible. You would only be told after it was impossible to cover up any further. The collapse of the global debt Ponzi will be no different.

JPM update looks similar to my model.

In this post I indicated that JPM chart had peaked an ending diagonal and broken down below the lower rail. At that point my model expected 5 of 1 to head down to about $53. As you can see from the updated chart, that is just about where it bottomed. It has since been on the slow mend but there is no conviction in this buying IMO. It is just filling the gap and trying to a-b-c back to the prior 4th wave which is also about the 38.2 fib as you can see from the lower zoom in picture.

We will know that JPM is about to collapse in a 3rd wave down if it cannot take out the 38.2 fib. I have my strong doubts about that. The banks are all in deep trouble. Nothing has been fixed, all of their balance sheets are capital impaired if the federal reserve loses control of the bond market and by my model, the dollar is getting stronger. That means higher interest rates are likely not far behind.

Here is my dollar model using the UUP ETF as a proxy. You can see in that post how I modeled that the throw under was done and that a break out of the top channel was imminent. Fast forward to today and that is just what happened. Look at how the chart broke out and then did a perfect back test - Prechter's goodbye kiss - before pushing upward.

Now, this is still a 3 wave movement so we only have 1st confirmation of the breakout. It could take 5 waves up and then an a-b-c back and then a massive 3rd wave breakout before the market begins to believe that a real direction change is in. But the fed has to unwind its balance sheet or at the very least not load it down any further with trash and so the banks will not be able to make free money just by making loans on crappy assets that are not nearly worth the money loaned (AKA all of the coastal housing in the USA). In other words, the banks have been making the loans, taking in the fees and then giving it to the federal reserve to hold onto. But if the fed can't take on any more of this crap, how are banks to make any money at all?

This is why they will plummet. By using the federal reserve as a dumping ground for their bad loans today, they are clearing the market of all credit worthy borrowers and then cutting deeply into the non credit worthy borrowers. If they want to continue making profits from their loan origination fees then they will have to add more crap loans to their own books. In other words, the city dump known as the federal reserve is closed for business and so new junk that they collect can't be so easily pawned off onto the taxpayer.

JPM is going to plummet well below $10 and probably below $5 before this collapse is done playing out.

We will know that JPM is about to collapse in a 3rd wave down if it cannot take out the 38.2 fib. I have my strong doubts about that. The banks are all in deep trouble. Nothing has been fixed, all of their balance sheets are capital impaired if the federal reserve loses control of the bond market and by my model, the dollar is getting stronger. That means higher interest rates are likely not far behind.

Here is my dollar model using the UUP ETF as a proxy. You can see in that post how I modeled that the throw under was done and that a break out of the top channel was imminent. Fast forward to today and that is just what happened. Look at how the chart broke out and then did a perfect back test - Prechter's goodbye kiss - before pushing upward.

Now, this is still a 3 wave movement so we only have 1st confirmation of the breakout. It could take 5 waves up and then an a-b-c back and then a massive 3rd wave breakout before the market begins to believe that a real direction change is in. But the fed has to unwind its balance sheet or at the very least not load it down any further with trash and so the banks will not be able to make free money just by making loans on crappy assets that are not nearly worth the money loaned (AKA all of the coastal housing in the USA). In other words, the banks have been making the loans, taking in the fees and then giving it to the federal reserve to hold onto. But if the fed can't take on any more of this crap, how are banks to make any money at all?

This is why they will plummet. By using the federal reserve as a dumping ground for their bad loans today, they are clearing the market of all credit worthy borrowers and then cutting deeply into the non credit worthy borrowers. If they want to continue making profits from their loan origination fees then they will have to add more crap loans to their own books. In other words, the city dump known as the federal reserve is closed for business and so new junk that they collect can't be so easily pawned off onto the taxpayer.

JPM is going to plummet well below $10 and probably below $5 before this collapse is done playing out.

Wednesday, May 28, 2014

Metals and miners update

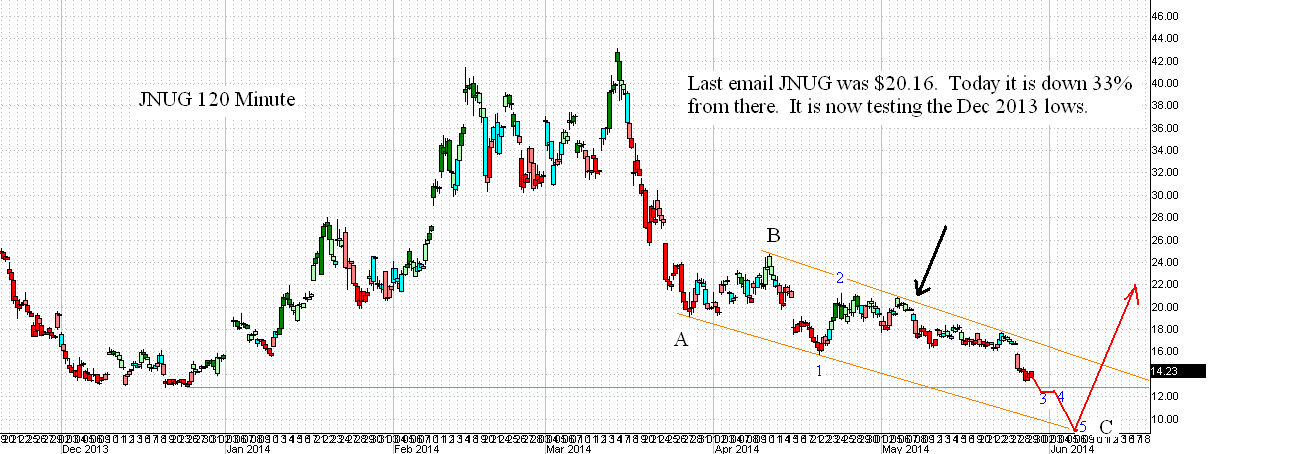

In this post from May 6th I indicated that I thought a major decision had to be made by M+M. In fact, immediately after I made that post (at the black arrow), the proxy stock I was using in that post (JNUG) gapped down and then proceeded to break down down pretty hard.

In addition, the Junior miners ETF (GDXJ) just broke below its June 2013 low. IMO that spells both near term trouble and major opportunity. The high level model has now changed to the one below. The implication here is that we are not working on an ending diagonal but rather a large 4th wave triangle. The bottom rail should be either horizontal or perhaps downward sloping a bit as shown below. The reason I chose that downward slope for the model is that it is the line drawn through the declining double bottom circled near blue 2. These lines have been quite accurate of late in predicting the future direction of the chart. Having said that, I would go on high alert bottom watch if the GDXJ chart hits about $28 which is where a horizontal line drawn from blue 2 would take us.

If this chart plays out then it will smash JNUG and it will bash the junior minors even more than they already are. I could represent a good short term trade, especially on JNUG. If GDXJ nearly doubles on the bounce, JNUG will nearly quadruple. I'm keeping a nice pile of cash on the sideline hoping this model plays out.

In addition, the Junior miners ETF (GDXJ) just broke below its June 2013 low. IMO that spells both near term trouble and major opportunity. The high level model has now changed to the one below. The implication here is that we are not working on an ending diagonal but rather a large 4th wave triangle. The bottom rail should be either horizontal or perhaps downward sloping a bit as shown below. The reason I chose that downward slope for the model is that it is the line drawn through the declining double bottom circled near blue 2. These lines have been quite accurate of late in predicting the future direction of the chart. Having said that, I would go on high alert bottom watch if the GDXJ chart hits about $28 which is where a horizontal line drawn from blue 2 would take us.

If this chart plays out then it will smash JNUG and it will bash the junior minors even more than they already are. I could represent a good short term trade, especially on JNUG. If GDXJ nearly doubles on the bounce, JNUG will nearly quadruple. I'm keeping a nice pile of cash on the sideline hoping this model plays out.

Tuesday, May 27, 2014

How much longer can there be confidence when officials are talking like this?

When members of the Ponzi Proliferation Project (AKA the European Central Bank or "ECB") begin to speak openly about the whole fiat currency based system of the Eurozone as "pure fiction", much longer can the rank and file patsy remain confident in the system? As I predicted many times in these pages long before there was even a hint of it happening, key members of the system are becoming whistle blowers. It's not that they are honest people. IF they were then they never would have participated in the scam in the first place. No, their revelations are more likely driven by the desire to avoid the historical reward of traitors once the people awake from their slumber and realize just how badly they have gotten screwed by the treasonous treachery of the con men.

By copping to the truth now, they hope to be viewed as a hero and a truth teller rather than what they really are which is someone who has already cashed out of the system and is now afraid that the careless buffoons who have been left running "the operation" are getting too greedy and will thus lead the system to a massive collapse wherein thousands if not tens of thousands of angry victims, now thinking they have nothing to lose, go out and "lose it". This is how oligarchs and elitists have gotten killed in the streets in the past. Anyone who thinks we have seen the last of that is not thinking. The sheer number of people who are going to wake up one day and find that they have lost everything is going to guarantee civil unrest on a scale never before witnessed on this planet.

Yeah I know, it sounds so distant and so extreme. But this is an old game, one that has played out many times in the past. With a hat tip to old Patrick Swayze, we ain't seen bad yet, but it's coming.

By copping to the truth now, they hope to be viewed as a hero and a truth teller rather than what they really are which is someone who has already cashed out of the system and is now afraid that the careless buffoons who have been left running "the operation" are getting too greedy and will thus lead the system to a massive collapse wherein thousands if not tens of thousands of angry victims, now thinking they have nothing to lose, go out and "lose it". This is how oligarchs and elitists have gotten killed in the streets in the past. Anyone who thinks we have seen the last of that is not thinking. The sheer number of people who are going to wake up one day and find that they have lost everything is going to guarantee civil unrest on a scale never before witnessed on this planet.

Yeah I know, it sounds so distant and so extreme. But this is an old game, one that has played out many times in the past. With a hat tip to old Patrick Swayze, we ain't seen bad yet, but it's coming.

Greg Caravan from The Daily Reckoning Austrailia edition

Greg Caravan's latest post covers a few things of interest including the gold and silver fix (a technical term in the industry). The process of fixing metals prices has been around for over 100 years and very soon it will be abandoned. Those involved seem to be trying to distance themselves from the activity. I can only surmise that it is, for whatever reason, no longer profitable. Notably, Deutsche Bank first tried to sell its seat on the fixing committee which would imply that there used to be some kind of value associated with it. Keep in mind, it was supposed to be a service, not a money maker. It is very typical that things which initially bill themselves as services tend to, over time, turn into scams. You know, like most of current government.

In any case, there were no takers for this seat and Deutsche Bank didn't even leave it on the market for very long before just deciding to abdicate. I guess the liabilities of this service are catching up to it now that gold price fixing is starting to be investigated the same as the LIBOR fix. Maybe the con men running that show could see that what is coming around the corner is not just fines on their criminal behavior but jail time. It's all part of the coming wave of conservatism IMO.

Greg Caravan's article noted the lack of jail time for any of the major con men of the bankster clan over the past few years. He noted that fines against companies (which most of the time don't even have to admit to any wrong doing) have just been the cost of doing business. He considers these government attacks nothing more than a form of taxation by a complicit greedy government. Greg is right about all of this.

Greg goes on to say that "The fining of Barclay’s for manipulating the gold fix highlights what a degenerate racket the whole financial system has become. It’s a great business model for banks and governments." "Degenerate racket". That's Greg's Aussie way of saying "organized crime" folks. More and more people seem to understand this truth now. Greg goes on to talk about "degenerate capitalism" which is what I would call crony capitalism. So Greg's article pretty much reinforces things that I have been writing for years. Of course, all of the folks at the Daily Reckoning have known all of this for a long time and have been writing about it before I began my blog. So perhaps I have really just been reinforcing their themes...

The one area where Greg and I differ. In fact I differ in this way from 99.99% of all the other folks out there who are are otherwise very like minded with me. That area is pointed out by his words, "Don’t expect any of this to stop. It’s what happens in the latter stages of degenerate capitalism. Critics are quick to point out that capitalism is the problem. It’s not. The chief problem is the constant manipulation of the rate of interest. By holding interest rates for a prolonged period below the ‘natural rate’ (the free market rate where the needs of savers and investors are balanced out) you create distortions on such a grand scale there is practically no fix apart from a system bust up."

IMO, Greg is like everyone else, talking about the symptoms while missing the root cause. Crony capitalism cannot work with an honest money supply. It might want to work but it simply cannot. Government will dictate and mandate and set interest rates all day long to no avail if the money supply is honest.

Why? Because it takes debt in order to manipulate the interest rates and without the ability to create more debt, all the fed can do is useless jawboning. The federal reserve has to rack up a bunch of IOUs to buy government treasuries so that the supply of them on the market is reduced, thus increasing the bond's value and lowering their interest rates. Without this ability to buy the debt and hide it on the books of the fed, interest rates could not be manipulated AT ALL.

I hope people will internalize that. None of this works by magic. It's just simple supply and demand. If the US treasury department increases the Treasury bond supply in order to pay for big government, wealth transfer programs (welfare for the poor) and corporate welfare then it has to try to sell these new bonds to someone. Without the federal reserve buying 90% of them, there would be no buyers at the current interest rates. Who wants to lock up money for 10 years at 2.5% per annum at a time when the annualized CPI (even by lying government standards) is well over 3%? If there are no buyers then the con men must sweeten the pot to attract them. In fact, Greenspan's predecessor Paul Volcker raised short term rates to nearly 16% for a short time in the early 1980s. He didn't want to, he had to. People around the world were losing confidence in greenbacks as a result of Nixon having defaulted on gold convertibility in 1971. High interest rates coaxed them back in.

So how does the federal reserve buy this Treasury debt, seemingly without limit? It can only happen because we have a dishonest money supply made up of fiat currency and fractional reserve banking. With fiat currency, the federal reserve is unrestricted in how many new dollars it prints up. And since 2008 we have learned that it can basically use them for any purpose it wants to: anything from propping up US and foreign banks to bailing out influential corporations like Harley Davidson and others. A federal reserve note is called a "note" because that is the legal term for a debt instrument. So in effect, the federal reserve can create new debt from thin air and use it to purchase anything it wants to in order to keep the Ponzi plate spinning. In this way, the government picks winners and losers. This is the essence of crony capitalism.

So you see, Greg is really talking about the symptoms: the manipulation of interest rates. This is NOT the root cause of the evil. The root cause is a fraudulent money supply. Take away the fraudulent money supply and replace it with an honest one and the fed would no longer be able to increase the money supply on the sneak and at will. For example, under a gold standard, more gold would have to be mined and put in the vaults before more currency could be issued. This is the hallmark of an honest money supply: a feedback mechanism that constrains the powers that be from criminal behavior without anyone even looking twice at them for it. In an honest money supply, if the money supply is increased the people can ask "why?" and "by what authority do you do it?". In a dishonest money supply there are no controls and the good old boy system takes care of itself and leaves you and me hanging out to twist in the wind.

Now for most people, all of this might seem academic. They don't see how it affects them but I assure you that it affects anyone who is bound to live under the system that uses the fraudulent and corrupt money supply. In order to understand this, please go back and review what money is supposed to be which is a store of value. Value can only be created through the labor of humans. So money is supposed to be a store of labor. If someone is creating fake money (which, if done by someone other than the government would be a crime known as counterfeiting) then they are effectively naked shorting human labor. In other words, they get to own human labor that they never earned.

When you naked short something, you effectively devalue it. If this devaluation is ongoing and systemic then it is tantamount to theft. Theft of people's labor has a name. We call it slavery. A fraudulent money supply enslaves the population which is stupid enough to labor under it. The people work day in and day out wondering why their labor never buys them the lifestyle that it would have bought them if they had been a settler in the early days of any country. Their labor would have built them shelter, provided clothing and food, and would have afforded them to have a family which would have been their social security program. Now all of these basic things are being pulled further and further from the people and the people have no clue why. Laboring under a dishonest money supply is a clear form of slavery whether or not the people understand it. Again, just because Madoff victims did not understand that they were being conned, did that make it any less true? Of course not. They were simpleton victims of a white collar criminal who was running a long con on them just like our government is doing to the people of the USA and other governments are doing to their people.

In any case, there were no takers for this seat and Deutsche Bank didn't even leave it on the market for very long before just deciding to abdicate. I guess the liabilities of this service are catching up to it now that gold price fixing is starting to be investigated the same as the LIBOR fix. Maybe the con men running that show could see that what is coming around the corner is not just fines on their criminal behavior but jail time. It's all part of the coming wave of conservatism IMO.

Greg Caravan's article noted the lack of jail time for any of the major con men of the bankster clan over the past few years. He noted that fines against companies (which most of the time don't even have to admit to any wrong doing) have just been the cost of doing business. He considers these government attacks nothing more than a form of taxation by a complicit greedy government. Greg is right about all of this.

Greg goes on to say that "The fining of Barclay’s for manipulating the gold fix highlights what a degenerate racket the whole financial system has become. It’s a great business model for banks and governments." "Degenerate racket". That's Greg's Aussie way of saying "organized crime" folks. More and more people seem to understand this truth now. Greg goes on to talk about "degenerate capitalism" which is what I would call crony capitalism. So Greg's article pretty much reinforces things that I have been writing for years. Of course, all of the folks at the Daily Reckoning have known all of this for a long time and have been writing about it before I began my blog. So perhaps I have really just been reinforcing their themes...

The one area where Greg and I differ. In fact I differ in this way from 99.99% of all the other folks out there who are are otherwise very like minded with me. That area is pointed out by his words, "Don’t expect any of this to stop. It’s what happens in the latter stages of degenerate capitalism. Critics are quick to point out that capitalism is the problem. It’s not. The chief problem is the constant manipulation of the rate of interest. By holding interest rates for a prolonged period below the ‘natural rate’ (the free market rate where the needs of savers and investors are balanced out) you create distortions on such a grand scale there is practically no fix apart from a system bust up."

IMO, Greg is like everyone else, talking about the symptoms while missing the root cause. Crony capitalism cannot work with an honest money supply. It might want to work but it simply cannot. Government will dictate and mandate and set interest rates all day long to no avail if the money supply is honest.

Why? Because it takes debt in order to manipulate the interest rates and without the ability to create more debt, all the fed can do is useless jawboning. The federal reserve has to rack up a bunch of IOUs to buy government treasuries so that the supply of them on the market is reduced, thus increasing the bond's value and lowering their interest rates. Without this ability to buy the debt and hide it on the books of the fed, interest rates could not be manipulated AT ALL.

I hope people will internalize that. None of this works by magic. It's just simple supply and demand. If the US treasury department increases the Treasury bond supply in order to pay for big government, wealth transfer programs (welfare for the poor) and corporate welfare then it has to try to sell these new bonds to someone. Without the federal reserve buying 90% of them, there would be no buyers at the current interest rates. Who wants to lock up money for 10 years at 2.5% per annum at a time when the annualized CPI (even by lying government standards) is well over 3%? If there are no buyers then the con men must sweeten the pot to attract them. In fact, Greenspan's predecessor Paul Volcker raised short term rates to nearly 16% for a short time in the early 1980s. He didn't want to, he had to. People around the world were losing confidence in greenbacks as a result of Nixon having defaulted on gold convertibility in 1971. High interest rates coaxed them back in.

So how does the federal reserve buy this Treasury debt, seemingly without limit? It can only happen because we have a dishonest money supply made up of fiat currency and fractional reserve banking. With fiat currency, the federal reserve is unrestricted in how many new dollars it prints up. And since 2008 we have learned that it can basically use them for any purpose it wants to: anything from propping up US and foreign banks to bailing out influential corporations like Harley Davidson and others. A federal reserve note is called a "note" because that is the legal term for a debt instrument. So in effect, the federal reserve can create new debt from thin air and use it to purchase anything it wants to in order to keep the Ponzi plate spinning. In this way, the government picks winners and losers. This is the essence of crony capitalism.

So you see, Greg is really talking about the symptoms: the manipulation of interest rates. This is NOT the root cause of the evil. The root cause is a fraudulent money supply. Take away the fraudulent money supply and replace it with an honest one and the fed would no longer be able to increase the money supply on the sneak and at will. For example, under a gold standard, more gold would have to be mined and put in the vaults before more currency could be issued. This is the hallmark of an honest money supply: a feedback mechanism that constrains the powers that be from criminal behavior without anyone even looking twice at them for it. In an honest money supply, if the money supply is increased the people can ask "why?" and "by what authority do you do it?". In a dishonest money supply there are no controls and the good old boy system takes care of itself and leaves you and me hanging out to twist in the wind.

Now for most people, all of this might seem academic. They don't see how it affects them but I assure you that it affects anyone who is bound to live under the system that uses the fraudulent and corrupt money supply. In order to understand this, please go back and review what money is supposed to be which is a store of value. Value can only be created through the labor of humans. So money is supposed to be a store of labor. If someone is creating fake money (which, if done by someone other than the government would be a crime known as counterfeiting) then they are effectively naked shorting human labor. In other words, they get to own human labor that they never earned.

When you naked short something, you effectively devalue it. If this devaluation is ongoing and systemic then it is tantamount to theft. Theft of people's labor has a name. We call it slavery. A fraudulent money supply enslaves the population which is stupid enough to labor under it. The people work day in and day out wondering why their labor never buys them the lifestyle that it would have bought them if they had been a settler in the early days of any country. Their labor would have built them shelter, provided clothing and food, and would have afforded them to have a family which would have been their social security program. Now all of these basic things are being pulled further and further from the people and the people have no clue why. Laboring under a dishonest money supply is a clear form of slavery whether or not the people understand it. Again, just because Madoff victims did not understand that they were being conned, did that make it any less true? Of course not. They were simpleton victims of a white collar criminal who was running a long con on them just like our government is doing to the people of the USA and other governments are doing to their people.

Saturday, May 24, 2014

TRX Memorial Day 2014 update

Here is my previous post on TRX. The model predicted a significant pullback to around $1.80. The price at that time was $2.47. Today's update should highlight two major points:

As usual, an ending diagonal is not confirmed until the chart at least touches the bottom rail (but more likely breaks down through it) and then comes back up into the channel (1st confirmation) and then subsequently break out the top rail (2nd confirmation). Any subsequent break down through the top rail is cause to sell immediately as the pattern will have been invalidated. But what we have here appears to be a very nice inclining double bottom in the making. There is every chance of making 80-100% in the next 3 months if you can catch this at $1.78-$1.80. The C wave shown is where C=A. If C were just 38.2 % stronger than A then that's where the doubling potential comes in.

A regular reader recently asked a question about TRX, wondering if it was good value at these levels. My response (see comments section of this post) might be worth your time to read because you just don't see people speaking plainly about stocks very often. It is common to come up with all manner of ways to impute value onto the shares in order to create the perception of value where no real value exists. I'm not selling anything so I don't need to do that. Even my blog loads lightening fast because I'm not selling 3rd party controlled, malware-ridden ad space. It allows me to retain an unbiased view that I hope is at least entertaining if not useful and informative.

Bottom line: stocks that do not pay dividends have no value. None. Zero. Any valuation of them is just made up by stock salesmen who ask you to imagine a time in the future when value could possibly appear so that they can offload stocks on you TODAY and collect a trading fee. So in that sense, TRX is a horrible "value". Even at 10 cents it would not be a "bargain". But the chart suggests that current holders of the shares should see an influx of idiots who don't understand this and that represents an opportunity to sell to a greater fool in a couple of months at a fat profit. This is what I am suggesting, and it is what I myself intend to do. My plan is to take advantage of fellow speculators while at the same time they attempt to do the same to me. It's pure gambling and anyone who calls it investing is either a patsy or a con man.

- At the current price of $1.88, TRX is rapidly approaching my retracement price target.

- The wave structure itself is not playing out as expected.

As usual, an ending diagonal is not confirmed until the chart at least touches the bottom rail (but more likely breaks down through it) and then comes back up into the channel (1st confirmation) and then subsequently break out the top rail (2nd confirmation). Any subsequent break down through the top rail is cause to sell immediately as the pattern will have been invalidated. But what we have here appears to be a very nice inclining double bottom in the making. There is every chance of making 80-100% in the next 3 months if you can catch this at $1.78-$1.80. The C wave shown is where C=A. If C were just 38.2 % stronger than A then that's where the doubling potential comes in.

A regular reader recently asked a question about TRX, wondering if it was good value at these levels. My response (see comments section of this post) might be worth your time to read because you just don't see people speaking plainly about stocks very often. It is common to come up with all manner of ways to impute value onto the shares in order to create the perception of value where no real value exists. I'm not selling anything so I don't need to do that. Even my blog loads lightening fast because I'm not selling 3rd party controlled, malware-ridden ad space. It allows me to retain an unbiased view that I hope is at least entertaining if not useful and informative.

Bottom line: stocks that do not pay dividends have no value. None. Zero. Any valuation of them is just made up by stock salesmen who ask you to imagine a time in the future when value could possibly appear so that they can offload stocks on you TODAY and collect a trading fee. So in that sense, TRX is a horrible "value". Even at 10 cents it would not be a "bargain". But the chart suggests that current holders of the shares should see an influx of idiots who don't understand this and that represents an opportunity to sell to a greater fool in a couple of months at a fat profit. This is what I am suggesting, and it is what I myself intend to do. My plan is to take advantage of fellow speculators while at the same time they attempt to do the same to me. It's pure gambling and anyone who calls it investing is either a patsy or a con man.

Friday, May 23, 2014

Memorial Day 2014 $COMPX update

We just hit a long 3 day weekend for Memorial Day. Typically, the market participants are refreshed and bullish upon return from holidays. So the odds are against the bears in that aspect come Tuesday. But the chart of the $COMPX is not bullish looking no matter how I view it. The action since the recent bottom has not been motive. It has been corrective looking in nature, all choppy and undecided. At 4210 the chart will hit the 61.8 fib so there could be a pop out of the gate and then the selling could begin. I think wave 2 should be finished very shortly.

Below are the 60 and 15 minute charts. On the left hand 60 minute chart the structure of an ending diagonal is apparent. We saw blue a, then an easy to count a-b-c down into blue b and then 5 rail bounces with a throw over on the 5th wave. Each of these rail bounces is supposed to be an a-b-c. This 3 wave structure should consist of a 5-3-5 sequence where:

Below are the 60 and 15 minute charts. On the left hand 60 minute chart the structure of an ending diagonal is apparent. We saw blue a, then an easy to count a-b-c down into blue b and then 5 rail bounces with a throw over on the 5th wave. Each of these rail bounces is supposed to be an a-b-c. This 3 wave structure should consist of a 5-3-5 sequence where:

- The c wave is the most powerful and should contain a gap in its 3rd wave (it does)

- C often throws over the top channel rail (it did)

- C should be made up of 5 easy to read waves. See the right hand picture, this is apparent.

- If 3 of C is the extended wave of the C wave (which it is) then 5 should be about the same length as wave 1. It will be the same length if 5 moves up to the top of the vertical blue line.

- The whole 5th wave also seems to count well as an ending diagonal as shown by the orange lines in the right hand picture. If this continues to hold, we should get a few points up at the open which putter out quickly and then reverse with some gusto back down through both rails of the ending diagonal. If it does then and then goes back up through the diagonal then the pattern is bust and caution should be exercised.

There are other possibilities but this is my top model for right now. That could change very early Monday AM. I will say that there are a lot of people out there calling for pullbacks and that is not how bull markets typically end. They usually end with everyone saying "Dow 40,000 soon".

Facebook update

In this post I correctly modeled the timing on re-entry of FB short positions. However, I did not expect a triangle to form here. Longer term, it's good news for FB gamblers but short-mid term it is screaming that massive pain is about to hit.

The model below assumes that the C wave will be about the same length as the a wave. That would take it to the level of the prior 4th. This is best case IMO and we will know by the length of the coming first wave down how likely this scenario is going to be.

It should be known that ending diagonals are also known for retracing their entire length. In other words, FB shares could turn out to be a mania. This would not surprise me at all. But for shorting purposes, the safe bet is to assume a normal a-b-c movement back to around $40.

Zooming in for more detail, it looks to me like the B wave has completed and that the breakdown is already in the very early stages. The confirmation is the break below the lower rail. Again, best case is a 30% haircut from here and if I see 5 clear waves down that stop there then as much as I think FB is a waste of time, I will have to call it a buy. Why? Because that would suggest that it is a 2nd wave in the bigger picture and that a large 3rd wave up could be coming. This makes no sense to me at this point given what an economic waste the whole facebook concept is but perhaps it suggests that Zuckerberg will expand into the wide open spaces of cloud based AI - something that I think the world is just begging for. If he goes there, and his recent purchase of an AI think tank suggests that this is his future direction, then FB could explode upwards because cloud AI is wide open, has no competitors or products right now and FB could get the first mover advantage. Google had years to capitalize on this but just didn't seem to have the vision to do much of ECONOMIC VALUE past web search.

In any case, wild speculation aside, FB is a SELL SELL SELL right here.

Important note: If the chart goes up one more wave then the B wave triangle model is in serious jeopardy because that would be 5 waves up from what I modeled as "d", and the "e" wave is only supposed to be 3 waves (5-3-5). In the very short term it would mean that the shares could rally back to $64 (level of the prior 4th) but then that would be wave 2, not wave B. The implications are that the $40 price level would no longer be the primary model and in that case I would start to give odds to FB becoming a mania stock, retracing all of its gains.

Final thought: If FB is retracing even back to $40, what will the rest of the markets be doing, just sitting there? I think not. If FB is going down, everyone will likely be going down. In fact, it's likely the other way around. If the broader markets go into massive decline, FB will get sucked down with the rest of the stocks.

The model below assumes that the C wave will be about the same length as the a wave. That would take it to the level of the prior 4th. This is best case IMO and we will know by the length of the coming first wave down how likely this scenario is going to be.

It should be known that ending diagonals are also known for retracing their entire length. In other words, FB shares could turn out to be a mania. This would not surprise me at all. But for shorting purposes, the safe bet is to assume a normal a-b-c movement back to around $40.

Zooming in for more detail, it looks to me like the B wave has completed and that the breakdown is already in the very early stages. The confirmation is the break below the lower rail. Again, best case is a 30% haircut from here and if I see 5 clear waves down that stop there then as much as I think FB is a waste of time, I will have to call it a buy. Why? Because that would suggest that it is a 2nd wave in the bigger picture and that a large 3rd wave up could be coming. This makes no sense to me at this point given what an economic waste the whole facebook concept is but perhaps it suggests that Zuckerberg will expand into the wide open spaces of cloud based AI - something that I think the world is just begging for. If he goes there, and his recent purchase of an AI think tank suggests that this is his future direction, then FB could explode upwards because cloud AI is wide open, has no competitors or products right now and FB could get the first mover advantage. Google had years to capitalize on this but just didn't seem to have the vision to do much of ECONOMIC VALUE past web search.

In any case, wild speculation aside, FB is a SELL SELL SELL right here.

Important note: If the chart goes up one more wave then the B wave triangle model is in serious jeopardy because that would be 5 waves up from what I modeled as "d", and the "e" wave is only supposed to be 3 waves (5-3-5). In the very short term it would mean that the shares could rally back to $64 (level of the prior 4th) but then that would be wave 2, not wave B. The implications are that the $40 price level would no longer be the primary model and in that case I would start to give odds to FB becoming a mania stock, retracing all of its gains.

Final thought: If FB is retracing even back to $40, what will the rest of the markets be doing, just sitting there? I think not. If FB is going down, everyone will likely be going down. In fact, it's likely the other way around. If the broader markets go into massive decline, FB will get sucked down with the rest of the stocks.

Wednesday, May 21, 2014

TWTR Update

TWTR threw under, but not as hard as expected. Could this be an inclining double bottom forming right here? If so, then perhaps the indices have a bit more of a rally in them than I thought because I just don't see how TWTR moves up if broader markets are supposed to turn down hard...

In any case, a break above the green line would be worth a speculative buy hoping that the shares will pop the 20% or so needed to fill the recent gaps and maybe even move up to the level of the prior 4th. I know there are a lot of short sellers in this stock right now. They are all likely waiting for the Dow to roll over in order to cover. But if the Dow just rallies for another week here, the short in TWTR will panic.

Of course, a subsequent break back down below the green will be the "sell this garbage stock" indicator.

In any case, a break above the green line would be worth a speculative buy hoping that the shares will pop the 20% or so needed to fill the recent gaps and maybe even move up to the level of the prior 4th. I know there are a lot of short sellers in this stock right now. They are all likely waiting for the Dow to roll over in order to cover. But if the Dow just rallies for another week here, the short in TWTR will panic.

Of course, a subsequent break back down below the green will be the "sell this garbage stock" indicator.

Lenders are starting to care about endless, consumption based deficit (AKA debt) spending.

New York, like many places where they cram too many people into to too small an area because they think "it takes a village", is bankrupt. They haven't had to admit it yet but it's coming. The public unions are sucking at the city's teats so hard that they are drawing blood. But they don't care because that is the way of the parasite. They will absolutely not only keep it up but increase the behavior, grabbing whatever they can from whomever is stupid enough to loan it to them until they finally have to default on all of it: payment for services owed, pensions, you name it. Anything for which actual payment can be deferred will be deferred. I'll gladly pay you Tuesday if you just let me have that hamburger today. Of course, Wimpy never paid a hamburger back because there was always a good reason not to.

Right now federal, state and many local governments are borrowing like mad. Why? In the infamous words of Bill Clinton, "because they can". They can do it because the interest rates have been manipulated to artificial all time lows by the federal reserve. But manipulation is not free. It isn't even cheap. The fed is running out of capacity to keep it up and when interest rates begin to rise, the full faith and credit of the US and of the individual states and cities is going to decline rapidly.

In fact, signs that the party is ending are all around us for anyone who will see. Today's news sees bond firms bailing out of NYC debt due to capo (mayor) Blasio's out of control plans to increase the debt based consumption. The article says his "plan to pay for labor contracts that boost deficits." Breaking it down into simple English, he is conspiring with the socialist union bosses to pay the city workers more than the taxpayers can afford in order to buy their loyalty. Of course, that continues up until the ability to acquire new debt runs out and then the Major will announce mass layoffs and a haircut for pensioners. In other words, they plan to default. They know it will happen. The math will not allow another outcome and so it is clearly fraudulent behavior. But they do it anyway because it suits their needs. They will stay in power and break the back of the people so that the people come begging to government for the basics of life. The con men are using the greed of the people to eventually destroy them. It is a treasonous plot and never let anyone tell you "we never saw it coming".

The days of the con grow short. As soon as the net inflows of new debt into the system turn into net outflows, the Ponzi has but a few months to live. The Ponzi requires new debt buyers all the time and if the herd looks at a big player like UBS and wonders why it is selling NYC debt then others could follow soon. The result of this paper hitting the market along with the continuous debt floating of the city itself would drive down debt value and drive up their interest rates, thus making the service of any new debt very painful.

Right now federal, state and many local governments are borrowing like mad. Why? In the infamous words of Bill Clinton, "because they can". They can do it because the interest rates have been manipulated to artificial all time lows by the federal reserve. But manipulation is not free. It isn't even cheap. The fed is running out of capacity to keep it up and when interest rates begin to rise, the full faith and credit of the US and of the individual states and cities is going to decline rapidly.

In fact, signs that the party is ending are all around us for anyone who will see. Today's news sees bond firms bailing out of NYC debt due to capo (mayor) Blasio's out of control plans to increase the debt based consumption. The article says his "plan to pay for labor contracts that boost deficits." Breaking it down into simple English, he is conspiring with the socialist union bosses to pay the city workers more than the taxpayers can afford in order to buy their loyalty. Of course, that continues up until the ability to acquire new debt runs out and then the Major will announce mass layoffs and a haircut for pensioners. In other words, they plan to default. They know it will happen. The math will not allow another outcome and so it is clearly fraudulent behavior. But they do it anyway because it suits their needs. They will stay in power and break the back of the people so that the people come begging to government for the basics of life. The con men are using the greed of the people to eventually destroy them. It is a treasonous plot and never let anyone tell you "we never saw it coming".