Sunday, July 26, 2020

What goes around comes around - wisdom for those with eyes to see.

The US is an empire just like all the other empires that have come and gone. Empires tend to be manias. Those who start them off have blue skies overhead and growth is easy. The best of the best are put into play in order to make something big happen. In time the empire begins coining its own money and then as growth slows down it begins cannibalizing its money. The cannibalization at first means clipping coins - literally clipping some of the metal off the coin. Then the coins are removed and replaced with paper. Then even the paper is removed and replaced with digital promises. Each time you move away from gold you are essentially adding a layer of abstraction which is to say a layer of leverage upon the core money which is gold.

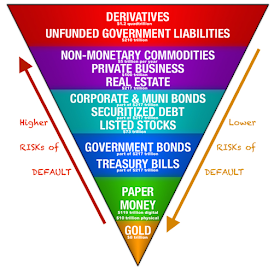

Today we call this Exter's pyramid and you can see how it looks at left. At the bottom you have gold which is money, the only real money in fact. With gold there is zero risk of default because it is not a placeholder of anything but in fact payment in full.

As you move up the chain the numbers get bigger but they get more fragile as well because they are debt/promise/leverage. Call it what you want, it's all the same thing. FAKE, TEMPORARY or ILLIQUID wealth.

You can argue all you want that real estate is wealth but who bought property during the Great Depression? NOBODY, that's who. Real estate went no bid because not only did people not have any money but neither did they want the liabilities. Think about rental apartments for example. If you own an apartment in an economic collapse you might think "no problem, I have an income stream". Yeah, right. What happens when your tenants lose their jobs and cannot pay? Well, if the economy is normal then you take them to court, get them evicted and the cops will physically remove them from the premises if needed. But what is coming is not normal times. In the coming collapse the government will make it illegal for the "greedy landlord" to evict. They will also demand rent reductions or rent increase moratoriums. Why? Because the voters will cry out "do something if you want to be elected again". Government has no money of its own so it will steal from whoever has something to take. Government will also raise taxes and fees and standards of maintenance, etc. on the landlords. You do NOT want to own property in a financial collapse.

But I digress. So the empire makes its money the global reserve currency and then each time it debases that currency, its people are effectively taxed but that taxation is shared by ALL holders of the fake money. And so the empire has a seemingly endless ability to print because the dilution is shared globally. There seems, for a time, to be no penalty for money printing.

At some point however all the currency of the realm will come back to the realm. Foreigners who, for whatever reason, no longer need and want to hold the empire's currency will flock back to the mother country of the empire to trade their fakebux for something tangible. This is true of the fake paper currency, the fake treasury debt (fake in that our government sees it as a gift, not debt), the fake corporate shares (just another fiat currency), and the fake derivatives. All of that dilution will at some point come back to the US in a tsunami of fake bux and then we will see massive price instability to the upside (rising prices).

It's coming folks and gold and silver are the canaries in the coal mine.

Thanks for shraing

ReplyDeleteThanks for sharing!

ReplyDeleteI don't really understand your prediction. I thought you said there would be deflation.

ReplyDeleteDrew, look around. Look at oil prices. Oil actually went negative for a very short period of time. Absolutely unprecedented deflation! Look at silver how it fell to $11. Look at global shipping - the greatest single industry depression I have ever seen. There's been plenty of debt deflation.

ReplyDeleteI'm still planning on a big deflationary market move. Perhaps sooner than people expect but within a couple years best case. In the long run inflation always wins. Why? Because the fake money is fake of course and all that has to happen is for people to realize this simple truth en masse. My supernova economy theory played out partially. Some things have deflated. Others are now inflating. But at the end of the day, a government with this much debt is past the point of no return. Why? Because the only way to stop the fall of the dollar is to either stop handing out free money (which will cause massive unrest) or raise interest rates and if we do that the debt debt service will consume us.

One way or the other, this is the end game.

I hope everyone followed my simple and simply stated survival strategy. Despite knowing that we could have a massive deflation before the hyperinflation arrives, I have ALWAYS said to cost average into gold and silver bullion coins. I have told people that my entire retirement is held in physical metals (besides some money that I use to trade the market with) and other assets like IBM pension, etc. I know gold and silver will never go worthless. Not ever. They are real, everything else I see is fake.